- Technology

New contract marks a transformational year for Agereh Technologies

Major U.S. Airport Launches Multi-Year AI Rollout

- February 20, 2026

- Editorial Feature

Agereh Technologies (TSXV: AUTO, OTCQB: CRBAF) has secured its first enterprise customer, deploying its full intelligence platform under a recurring SaaS agreement.

Across one of the busiest international airports in the United States, a new technology platform is going live.

Not the next aerospace breakthrough, or another security overhaul. But the real-time intelligence layer modern airports have quietly needed for years.

This marks a decisive shift for Agereh Technologies. The company is moving from pilot-stage to full-scale commercial deployment inside a complex, high-traffic environment.

Importantly, the airport committed to the company’s entire technology stack across multiple terminals.

- HeadCounter™ provides anonymous insight into how passengers move through a terminal, offering crucial data about where congestion forms and how traffic flows.

- MapNTrack™ allows airport operators to see where critical equipment is located. In large terminals where GPS signals break down, that has traditionally been difficult to achieve.

- Smart Door Sensor™ tracks door activity in real time, helping identify movement patterns across secure zones.

Implementing Agereh’s full technology suite is a true signal of confidence in the company’s end-to-end system.

And because Agereh operates on a subscription-based software model, the revenue stream it will produce is recurring.

This model also allows for the potential to scale quickly as adoption expands across additional terminals and facilities.

This initial enterprise launch will provide a reference case the company can use to demonstrate financial impact. As results are proven, from reduced congestion to stronger retail returns, Agereh (TSXV: AUTO, OTCQB: CRBAF) gains a repeatable framework for other airports and venues.

That’s when the sales dynamic shifts. Airports around the world face the same operational pressures, and they are only the starting point. The company’s proprietary hardware and software suite can adapt into logistics hubs, rail systems, ports, and cargo networks.

Solving The Multi-Million-Dollar Blind Spot Inside Modern Airports

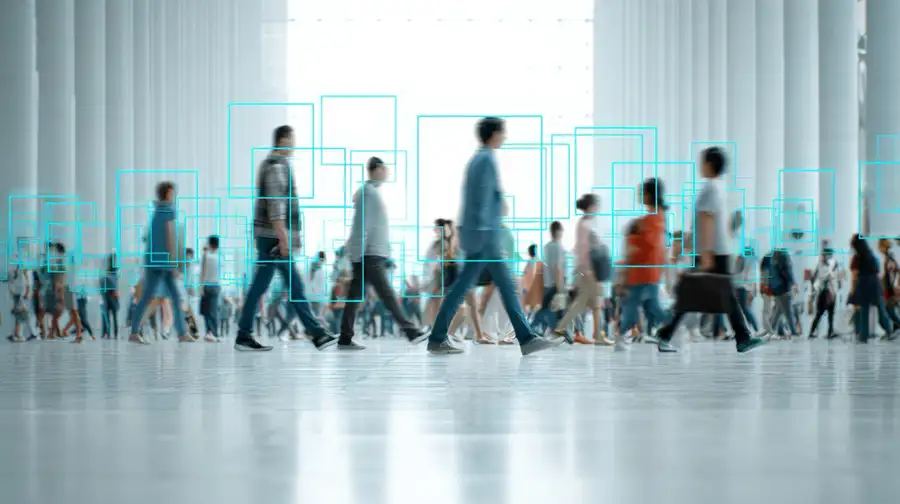

The need for transparency in airports is dire, as they face rising passenger volumes, tighter security demands, and growing commercial pressure.

Modern airports are operating at volumes never seen in history, and the pace continues to accelerate. Every day in the United States the FAA reports:

- 44,000+ flights

- More than 3 million airline passengers

- Operations spanning 29 million square miles of airspacei

On an annual basis, that translates to nearly 10 million scheduled passenger flights across almost 20,000 airports nationwide.ii

This surge in activity is reshaping how airports must operate. Systems designed for a slower era are no longer sufficient.

That’s why, across the country, aviation infrastructure is undergoing a once-in-a-generation modernization cycle.

Government agencies and private capital are pouring billions into new terminals, upgraded security systems, and expanded facilities. The Department of Homeland Security alone has allocated more than $1 billion toward airport technology and security upgrades.iii Thirteen U.S. airports are currently undergoing modernization projects exceeding $500 million each.iv

Yet one critical layer has lagged behind – real-time data on:

- How passengers move through terminals

- Where bottlenecks form, and why

- The location of critical mobile assets

- How movement patterns impact staff, safety, and retail performance

The consequences of this data gap can cost large airports millions of dollars annually.⁹

Equipment can sit idle in the wrong zones while staff spend valuable time searching for it.

Congestion can build without warning, creating security risks and passenger delays.

Retail and dining, which account for 40–50% of total airport revenue, can lose traffic when bottlenecks divert customers.v

That is the blind spot Agereh’s (TSXV: AUTO, OTCQB: CRBAF) AI-enabled platform is designed to eliminate.

And the applications extend well beyond the terminal.

Anywhere large volumes of people or goods move through complex environments, the need for real-time visibility is becoming increasingly critical.

From Airports to Global Cargo Networks

The same visibility gap that exists inside passenger terminals extends across global cargo networks, opening up another multi-billion industry for Agereh to transform.

The global delivery tracking systems market is expected to grow from $11.3 billion in 2025 to $31.4 billion by 2035 – more than doubling in a decade.vi

Every year, more than 380 billion packages move through shipping lanes. That’s over 12,000 parcels every second.vii

As e-commerce expands and supply chains grow more complicated, expectations around speed and transparency continue to rise.

Meanwhile port congestion, labor shortages, and geopolitical disruptions have made trade routes less predictable.

Industries transporting high-value or time-sensitive goods increasingly rely on air or sea transit. Delays can carry significant financial consequences, particularly for electronics, pharmaceuticals, and aerospace or automotive parts.

In an environment where millions of goods move every hour, even small improvements in tracking accuracy and reliability can have a significant financial impact.

To address this need, Agereh (TSXV: AUTO, OTCQB: CRBAF) developed the CellTrackerTag™. This cellular-based tracking device allows for continuous asset monitoring. Engineered for long battery life and broad network coverage, it allows cargo and equipment to be tracked across extended routes.

By reducing loss, delay, and misrouting of critical goods, the platform helps operators meet the tighter delivery windows demanded by modern supply chains.

6 Reasons to Watch Agereh Technologies (TSXV: AUTO, OTCQB: CRBAF)

First Enterprise Deployment Underway:

A major U.S. airport has launched a multi-year rollout of Agereh’s full platform across multiple terminals. This marks the company’s transition from pilot-stage commercialization to fully integrated enterprise deployment, establishing recurring revenue and providing a live reference case for expansion into additional airports and large-scale venues.

Positioned at the Center of a Multi-Billion-Dollar Infrastructure Upgrade:

U.S. airports, logistics hubs, and large-scale venues are entering a historic modernization cycle. As digital intelligence becomes as essential as physical expansion, Agereh’s platform is positioned where infrastructure spending is moving.

Purpose-Built Technology That Solves Problems Legacy Systems Can’t:

Agereh’s private-cellular, AI-enabled architecture delivers real-time intelligence without relying on cameras, public networks, or beacon grids. Its systems address the costliest blind spots in transportation and logistics operations.

One Architecture, Multiple High-Growth End Markets:

Agereh’s platform is designed to scale across aviation, air cargo, logistics centers, rail networks, shipping ports, and large public venues. As these sectors experience the same operational challenges, Agereh’s addressable market expands alongside them.

Revenue-Producing, SaaS-Based Business Model:

The company is generating revenue through a subscription-based software model that supports predictable recurring income, customer expansion, and scalability.

Experienced Leadership in Mission-Critical Technology:

Agereh is led by a team with decades of experience commercializing advanced hardware and software systems in complex, regulated environments.

Stay Informed as the Story Develops

With its first enterprise deployment live and a recurring revenue stream in place, the company has achieved an important milestone. What happens next will be shaped by adoption, scale, and execution.

If you’d like to stay up to date as Agereh (TSXV: AUTO, OTCQB: CRBAF) continues to roll out new deployments and share commercial and product updates, please sign up below to receive company news.

You can also visit the company’s website to explore additional information and conduct your own due diligence.

ihttps://www.faa.gov/air-traffic-by-the-numbers

iihttps://www.carlyle.com/global-insights/jfk-new-terminal-one

iiihttps://www.dhs.gov/news/2024/02/16/dhs-announces-over-1-billion-airport-security-technology-upgrades

ivhttps://www.bnamericas.com/en/news/13-airports-will-be-modernized-with-more-than-us500mn-in-investment

vhttps://airports.org/airport-concessions-revenue-share

vihttps://www.futuremarketinsights.com/reports/delivery-tracking-platform-market

viihttps://capitaloneshopping.com/research/package-delivery-statistics/

IMPORTANT NOTICE AND DISCLAIMER

This article is a paid advertisement. Think Ink Marketing and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by profiled companies or third parties to organize marketing campaigns, which include the creation and dissemination of these types of communications. In this case, in an effort to enhance public awareness of for Agereh Technologies Inc. (“AUTO”) and its securities, AUTO has provided the Publisher with a budget of approximately $150,000 USD to cover the costs associated with the creation and distribution of this communication. The Publisher may retain any excess sums after expenses as its compensation. This compensation should be viewed as a major conflict with our ability to be unbiased. Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur. This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally AUTOlable to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by AUTO) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP.

The Publisher does not own any shares of AUTO and has no information concerning share ownership by others of in AUTO. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

FORWARD LOOKING STATEMENTS.

This publication contains forward-looking statements, including statements regarding expected continual AUTOwth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to AUTO’s industry; (b) market opportunity; (c) AUTO’s business plans and strategies; (d) services that AUTO intends to offer; (e) AUTO’s milestone projections and targets; (f) AUTO’s expectations regarding receipt of approval for regulatory applications; (g) AUTO’s intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) AUTO’s expectations regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute AUTO’s business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) AUTO’s ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) AUTO’s ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) AUTO’s ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of AUTO to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) AUTO operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact AUTO’s business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing AUTO’s business operations (e) AUTO may be unable to implement its AUTOwth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

INDEMNIFICATION/RELEASE OF LIABILITY.

By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

INTELLECTUAL PROPERTY.

Think Ink Marketing is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Tycona Media Ltd. Articles appearing on this website should be considered paid advertisements. Tycona Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

The Website Host has been paid approximately $500 per month while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling Agereh Technologies Inc. (“AUTO”).

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled compannies and has no information concerning share ownership by others of any profiled companies. The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of AUTO or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about AUTO Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in AUTO’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and AUTOlability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Tomorrow Investor is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding AUTO’s future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to AUTO’s industry; (b) market opportunity; (c) AUTO’s business plans and strategies; (d) services that AUTO intends to offer; (e) AUTO’s milestone projections and targets; (f) AUTO’s expectations regarding receipt of approval for regulatory applications; (g) AUTO’s intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) AUTO’s expectations regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute AUTO’s business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) AUTO’s ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) AUTO’s ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) AUTO’s ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of AUTO to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) AUTO’s operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact AUTO’s business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing AUTO’s business operations (e) AUTO may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of AUTO or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of AUTO or such entities and are not necessarily indicative of future performance of AUTO or such entities.

COMPANY SPOTLIGHT