Key takeaways:

- Auto shares remained stable despite the imposition of a 25% tariff on foreign imports.

- Exemptions for Canada and Mexico have played a crucial role in the muted market response.

- Experts express uncertainty regarding the long-term impacts on prices and sales within the automotive sector.

Introduction

In a surprising turn of events, shares of major auto manufacturers demonstrated resilience on Thursday following the announcement of significant tariffs by U.S. President Donald Trump. Key points include:

- The introduction of a 25% tariff on foreign auto imports.

- Canada and Mexico spared from these tariffs, providing some stability.

- Expectations for potential price increases and reduced sales as the situation develops.

Detailed Analysis

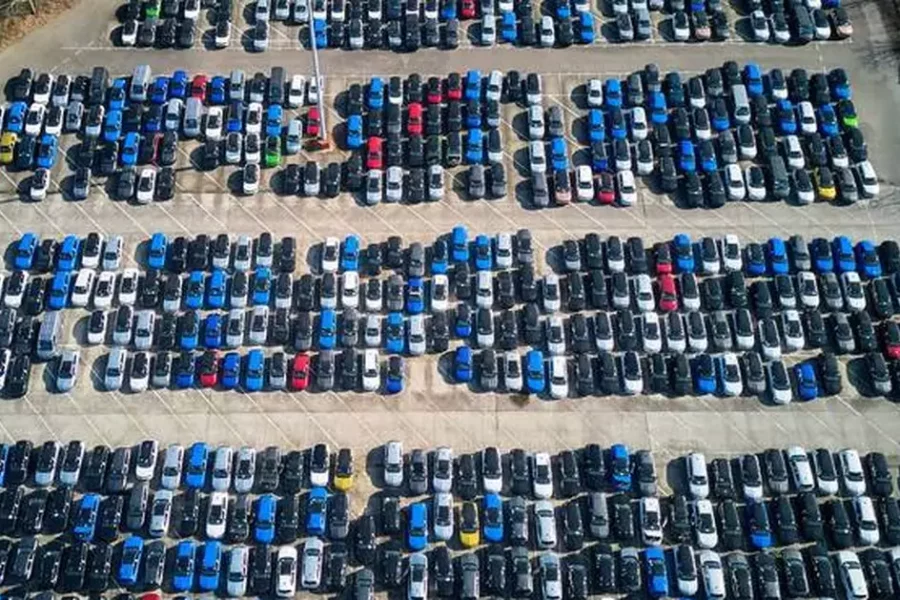

On April 3, 2025, shares of global automakers such as Volkswagen, Mercedes-Benz, and General Motors displayed unexpected stability despite the implementation of a 25% tariff on imported vehicles. Analysts attributed this strong market response in part to the favorable exemption of Canada and Mexico from the tariffs, which are essential to the North American automotive supply chain.

The tariffs, set to impose a baseline 10% duty on imports and as high as 34% on certain countries such as China, are part of a broader strategy to re-shape trade dynamics. However, the **exemption** of Canada and Mexico has alleviated some pressure on automakers operating in those regions 1.

Thomas Besson, head of autos research at Kepler Cheuvreux, suggested that investors might still limit their exposure to the sector, citing ongoing uncertainties in the market. “The long-awaited U.S. reciprocal tariffs announced have been large and broad-based, but critically exempt Canada and Mexico for now,” noted economists at RBC Capital Markets 2.

Despite the current market resilience, experts warn that the backdrop of U.S. tariffs will likely lead to price increases. Rico Luman, a senior sector economist with ING, highlighted that existing stock might initially absorb the shock, but as inventories deplete, consumers can expect significant price hikes 3.

Additionally, with the U.S. car market heavily reliant on imports from affected countries, analysts foresee a potential decline in vehicle sales as higher prices may limit consumer purchasing power. There is also speculation that automakers might reduce production as demand factors shift, impacting the supply chain dynamics further.

Conclusion

The tariff announcements have injected a considerable level of uncertainty into the automotive sector. While current market reactions have been surprisingly resilient due to key exemptions, analysts caution investors regarding the potential for future price increases and a decline in vehicle sales. Retail investors should closely monitor developments and reassess their exposure to the automotive industry in light of these changes, considering both short-term impacts and long-term implications for automotive stocks.

References

1 Auto giants surprisingly resilient as sweeping U.S. tariffs spare Canada and Mexico for now. CNBC. Retrieved April 3, 2025.

2 Auto giants surprisingly resilient as sweeping U.S. tariffs spare Canada and Mexico for now. CNBC. Retrieved April 3, 2025.

3 Auto giants surprisingly resilient as sweeping U.S. tariffs spare Canada and Mexico for now. CNBC. Retrieved April 3, 2025.