Dateline: CHARLOTTE, November 17, 2025 – Private equity firm Clayton Dubilier & Rice agreed to buy packaging giant Sealed Air Corp (SEE) for 10.3 billion, offering shareholders a 13% premium in an all-cash transaction 1. The deal values the bubble wrap maker at 42.15 per share and is expected to close in mid-2026, taking the Charlotte-based company private after decades on public markets.

Key Takeaways

- Shareholders receive 42.15 cash per share, 13% premium

- 10.3 billion enterprise value deal closes mid-2026

- Sealed Air board unanimously approved transaction

Market Reaction & Context

The premium represents a significant markup from Sealed Air’s November 11 closing price 3. The packaging industry has seen increased consolidation as private equity firms target companies with stable cash flows and essential products.

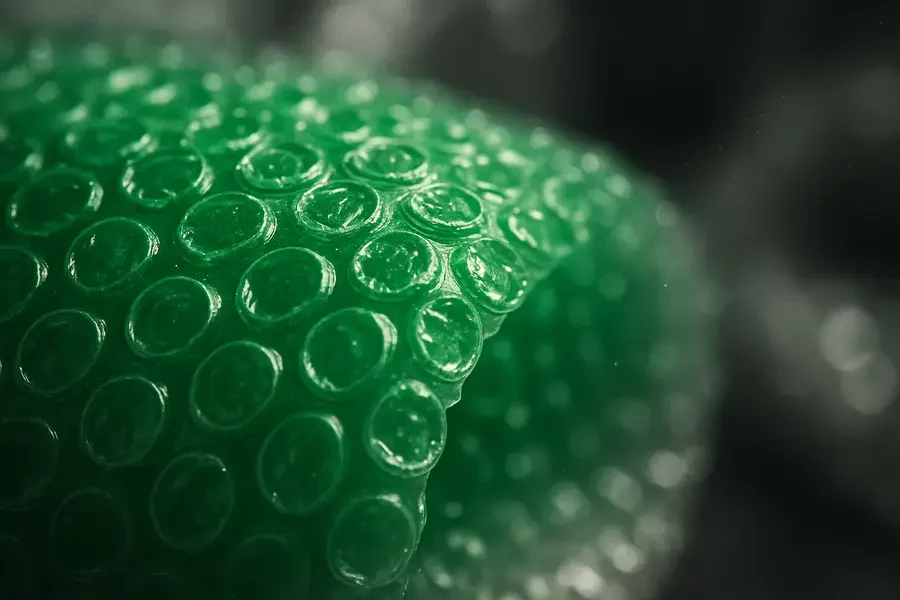

Sealed Air, known for inventing bubble wrap in 1960, competes with companies like International Paper and Sonoco Products in the industrial packaging space. The transaction removes a major player from public markets during a period of supply chain modernization.

Deal Structure

CD&R will finance the acquisition through a combination of debt and equity, with the transaction carrying an enterprise value of approximately 10.3 billion 2. Sealed Air’s board of directors unanimously approved the deal, which includes a 30-day “go-shop” provision allowing the company to solicit alternative offers.

The Charlotte manufacturing giant will become a private company under CD&R ownership, joining the private equity firm’s portfolio of industrial businesses 5. Debt financing arrangements are expected to be finalized prior to closing.

Strategic Rationale

The acquisition targets Sealed Air’s market-leading position in protective packaging and food packaging solutions. CD&R likely sees opportunities to optimize operations and invest in automation without quarterly earnings pressure.

Sealed Air operates globally with manufacturing facilities across North America, Europe, and Asia-Pacific regions. The company’s products serve food processing, e-commerce fulfillment, and industrial applications.

Timeline & Completion

The transaction is subject to customary closing conditions including regulatory approvals and shareholder consent. Both companies expect completion in mid-2026, providing an extended timeline for due diligence and financing arrangements 4.

Until closing, Sealed Air will continue operating as a publicly traded entity under existing management. The deal represents one of the larger private equity buyouts in the packaging sector this year.

Not investment advice. For informational purposes only.

References

1“Sealed Air to be Acquired by CD&R for 10.3 Billion”. PR Newswire. Retrieved November 17, 2025.

2“CD&R to Buy Sealed Air for 6.2 Billion”. Wall Street Journal. Retrieved November 17, 2025.

3“Bubble Wrap maker Sealed Air to go private in 10.3 billion CD&R deal”. Reuters. Retrieved November 17, 2025.

4“Sealed Air To Be Acquired By Funds Affiliated With CD&R”. Nasdaq. Retrieved November 17, 2025.

5“Charlotte manufacturing giant to go private in 10.3B deal”. Charlotte Business Journal. Retrieved November 17, 2025.

6“CD&R to take Sealed Air private for 10.3bn EV”. PE Hub. Retrieved November 17, 2025.

7“Sealed Air to be acquired By CD&R for 10.3 Billion”. TradingView. Retrieved November 17, 2025.

8“Sealed Air Announces Acquisition by CD&R for 10.3B”. TipRanks. Retrieved November 17, 2025.