- Commodities

- January 12, 2026

- Editorial Feature

Equinox Gold Achieves Record Production And Revenue Growth

This article is a paid advertisement for Equinox Gold Corp. (TSX: EQX | NYSE-A: EQX). Think Ink Marketing has been compensated for its marketing services. This content is not investment advice. Investing involves risk, and readers should do their own research before making any investment decisions. This article also includes forward-looking information and forward-looking statements within the meaning of applicable securities legislation and may include estimates of future financial or operational performance (collectively “Forward-looking Information”). Actual results may vary materially from the estimates and assumptions set out in any Forward-looking Information.

Equinox Gold’s founder has a long record of value creation - taking early-stage explorers to large-scale producers.

His flagship venture is scaling up, delivering a record 236K+ oz. of gold in Q3, and generating $819M in revenue year-to-date.

Investors who follow the name Ross Beaty know his legacy of building industry leaders.

As the founder of Pan American Silver, Beaty watched the company’s market cap climb from USD $110 million in Q1 1996 to nearly USD $10.16 billion today.1

Pan American is now the world’s second largest primary silver producer, with the world’s largest silver reserves and resources.

A Canadian Mining Hall of Fame inductee with numerous awards and medals to his name,2,3 Beaty held senior positions in Global Copper Corp. and Northern Peru Copper Corp.4 – which were acquired for over CAD $400 million each. And he founded and developed Lumina Copper, which he split into six companies and sold in a series of deals that amounted to nearly CAD $2 billion.5

That’s why, when Equinox Gold (TSX: EQX, NYSE-A: EQX) announced the CAD $7.7 billion merger with Calibre Mining6 Wall Street took notice.

Major institutional players are taking note too, with Vanguard, Sprott and some of the world’s pre-eminent gold investors holding stakes in Equinox Gold. Van Eck, one of the world’s largest gold-focused ETFs, currently owns ~12% of the company’s outstanding shares.

Over the past five years, Equinox Gold has executed an aggressive growth strategy. They’ve completed multiple strategic mergers and built five mines – all while navigating global supply shocks and a shifting geopolitical order.

Years of groundwork are finally yielding results: Equinox Gold has officially transitioned from builder to major producer.

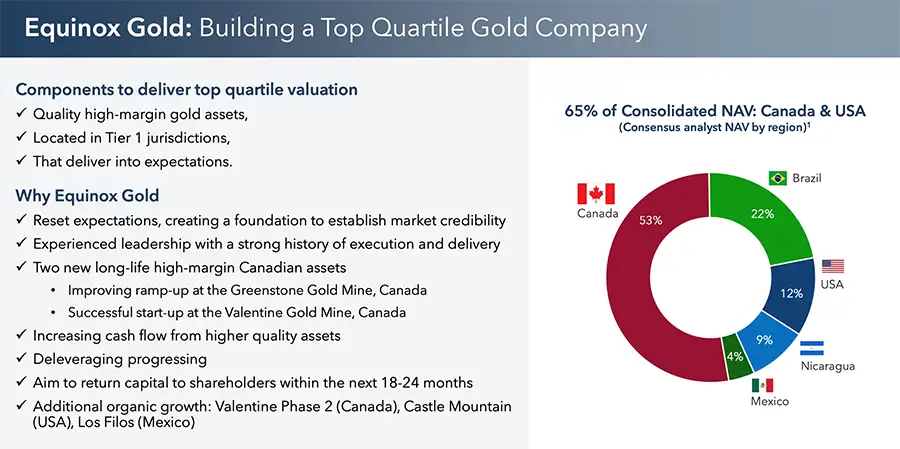

With two cornerstone Canadian assets ramping up production over the next 6-12 months, Equinox Gold is at a critical inflection point. And as illustrated below, they’re checking all the boxes.

Source: Corporate Presentation as of November 18, 2025, slide 3.6 Based on analyst consensus estimates at October 31, 2025.

With two Canadian mines advancing and its additional production base in Brazil, the USA and Nicaragua, Equinox Gold produced 236,000 ounces in the third quarter of 2025 and has issued full-year guidance of 785,000–915,000 ounces of gold.

This growth comes as gold prices trade near all-time highs, passing $4,000 an ounce in November.8 And unlike many previous gold rallies, this surge is supported by structural changes in central bank policy, sovereign debt, and long-term industrial and technological demand. 9

With production in top-tier jurisdictions, strong management and a clear path for growth, Equinox Gold (TSX: EQX, NYSE-A: EQX) ranks among the sector’s leading producers.

A Growth Pipeline Built for Scale

Equinox Gold (TSX: EQX, NYSE-A: EQX) has one of the largest gold endowments of its peer group, with more than 23 million ounces of proven and probable reserves, and an additional 22 million ounces in measured and indicated resources across the Americas.10

But it’s the next wave of production growth, led by two transformative Canadian mines, that will be key to the company’s expansion goals.11

High-Impact Mine Reaches Its Inflection Point

Located in a prolific mining district with a long history of gold production, the Greenstone mine holds over 5.7 million ounces in proven and probable reserves, and another 2.2 million ounces in measured and indicated.12

The mine achieved production in 2024 and Equinox Gold is now ramping up the operation.13 In Q3 mining rates exceeded over 185,000 tonnes per day, a 10% increase over Q2 and a 21% increase over Q1. Mill grades also improved to 1.05 grams per tonne (“g/t”) gold. In October the Greenstone team continued this trend, with mining rates climbing past 205,000 tonnes per day and mill grades improving to 1.34 g/t.

With both a large underground deposit that is not included in the current mine life, and additional near-mine and regional exploration potential, Greenstone also presents a compelling opportunity for both production growth and mine-life extension.

Equinox Gold (TSX: EQX, NYSE-A: EQX) owns 100% of Greenstone15, making it a key driver of their expanding portfolio.

Positioned to Drive Near-Term Cash Flow16

Commissioning at the Valentine Gold Mine is continuing ahead of expectations, with first ore in August 2025, first gold pour roughly one month later and the announcement of commercial production on November 18th. The plant has already consistently achieved 91% of nameplate capacity with recoveries over 93%, positioning Equinox Gold to deliver the higher end of its 15,000 – 30,000 oz. of gold production estimate for Q4, and 150,000 – 200,000 oz. of gold in 2026.

Valentine is located in Newfoundland17, one of Canada’s fastest-growing mining jurisdictions.18 In addition to its scale and economics, the location offers established infrastructure, a skilled local workforce, and reliable access to low-cost hydroelectric power – all factors that significantly de-risk production.

Designed to be a high-margin operation thanks to the shallow open-pit design,23 Valentine is expected to contribute meaningfully to near-term cash flow.24

The operation already holds approximately 2.7 million ounces of proven and probable reserves and an additional 1.3 million ounces of measured and indicated resources,19 but that is expected to grow.

Late last year, drilling at the Marathon Pit yielded an additional 44% gold at 47% higher grades than had been modelled in the reserve estimate, and the newly discovered Frank Zone represents has the potential to be developed into a new open pit.

It’s important to note that only a small portion of the Valentine Mine property has been explored.20 All 2.7 million ounces of reserves are contained in only 8 km of a 32-km fault line that runs across the property.21

The remaining 24 km has seen minimal exploration, but with similar geology to the well-known Sigma-Lamaque project in Val d’Or, which has produced about 10 million ounces of gold over its lifetime,22 Equinox Gold hopes to find additional mineralization as exploration continues along the trend.

Drilling at the Valentine Gold Mine has already discovered a new zone that has been traced over 1 km along strike and 500 metres deep, and follow-up drilling is underway. Previously reported results include 2.43 grams per tonne (“g/t”) gold over 172.8m estimated true width (“ETW”), including:

- 3.84 g/t gold over 90.1m ETW

- 2.12 g/t gold over 95.4m ETW

- 2.26 g/t gold over 78.3m ETW

- 3.08 g/t gold over 48.2m ETW

- 1.94 g/t gold over 36.4m ETW23

In addition, the company is advancing studies for a Phase 2 expansion that could double mill throughput to 5 million tonnes per year, potentially increasing annual production at this cornerstone asset.23

Federally Endorsed U.S. Gold Asset with FAST-41 Momentum

Castle Mountain is one of the few gold mines in the United States to receive formal federal endorsement.

In Q3 2025, the project was designated under FAST-41, a U.S. permitting initiative designed to fast-track environmental reviews for nationally significant infrastructure.xxvii

This places Castle Mountain on a short list of strategic mining projects aligned with U.S. priorities around domestic supply chain independence. That represents a major milestone: streamlined permitting de-risks the path to development.

Located in California’s historic Hart mining district, Castle Mountain was initially developed as a smaller-scale heap leach operation.The planned Phase 2 operation would transform it into a long-life, high-quality gold producer.xxvii

The project hosts over 4.1 million ounces in proven and probable reserves, along with an additional 1.47 million ounces in measured and indicated resources.xxviii

Once fully developed, Castle Mountain is expected to deliver an average of 220,000 ounces per year over a 14+ year mine life, according to a 2021 feasibility study.xxix

Equinox Gold (TSX: EQX, NYSE-A: EQX) is advancing toward a late-2026 Record of Decision. Development will leverage existing infrastructure and previously secured water rights, which should allow for an accelerated timeline to production.

Leadership With a Track Record of Execution

Equinox Gold (TSX: EQX, NYSE-A: EQX) is led by a team with deep operational expertise and decades of hands-on mining experience.

Collectively, they’ve developed and sold multiple companies. From grassroots development to billion-dollar exits, these individuals have helped shape the modern gold sector through strategic M&A transactions.

Ross Beaty, Chair & Founder

A Canadian Mining Hall of Fame inductee, Ross Beaty is one of the most respected figures in global mining. He is a geologist, past President of the Silver Institute in Washington D.C., a Fellow of the Geological Association of Canada and the Institute of Mining, and a recipient of the Institute’s Past President’s Memorial Medal.

He has received numerous awards and medals, including the Association of Mineral Exploration of BC’s Colin Spence Award, Mining Person of the Year from the Mining Association of BC and Northern Miner, Natural Resources & Energy Entrepreneur of the Year by Ernst & Young, the prestigious Viola MacMillan Award, CIM’s Vale Medal, and was appointed to the Order of Canada.30

Mr. Beaty has founded numerous successful resource companies over the last 50 years. That includes Pan American Silver, which now sits at a nearly USD $10.16 billion market cap.31 His ventures consistently attract institutional support.

Darren Hall, CEO & Director

Former President and CEO of Calibre Mining, Darren Hall led the company through its CAD $7.7 billion merger with Equinox Gold in 2025, and transitioned to Equinox Gold post merger to lead the expanded company as CEO.

He served as COO at both Calibre and Kirkland Lake Gold, which acquired Newmarket Gold where he was also COO.33 Prior to Newmarket Gold, Mr. Hall played a vital role at Newmont Mining, holding various positions over the course of almost 30 years.34 He is recognized for his ability to deliver on production guidance, optimize assets, and unlock long-term value through operational performance.

Douglas Forster, Director.

Mr. Forster was the founder and CEO of Newmarket Gold, acquired by Kirkland Lake Gold for CAD $1 billion in 2016. A co-founder of Calibre Mining and Terrane Metals, with more than 30 years in mining, he is known for turning resource assets into production-ready platforms.

Blayne Johnson, Director

A co-founder of Calibre Mining, Newmarket Gold, and Terrane Metals, Blayne Johnson has helped generate more than CAD $5 billion across his ventures. As Chairman of Featherstone Capital, he brings deep capital markets expertise to Equinox Gold’s Board, particularly in equity financing, corporate structuring, and strategic transactions.

With strong cash flow from producing mines, Equinox Gold has the flexibility to fund growth, manage risk, and scale intelligently.

And they’re backed by global institutions, ETFs, and long-term holders. With 4.5% insider ownership35, Equinox Gold maintains one of the strongest alignment profiles in the sector.

As gold enters a new phase, Equinox Gold (TSX: EQX, NYSE-A: EQX) has the strategy, assets, and team to crystallize the benefits in this strong gold cycle. Visit the company’s website to learn more or sign up below to receive updates as they’re released.

1 https://companiesmarketcap.com/pan-american-silvera/marketcap

2 https://mininghalloffame.ca/ross-j-beaty/

3 https://reuters.com/article/world/china/jiangxi-copper-to-complete-canadian-miner-buyout-soon-idUSSHA107405/

4 https://mininghalloffame.ca/ross-j-beaty/

5 https://www.equinoxgold.com/presentations/

6 https://www.nasdaq.com/articles/equinox-gold-and-calibre-mining-join-forces-c-26-billion-deal

7 https://www.kitco.com/charts/gold

8 https://www.forbes.com/sites/greatspeculations/2024/10/14/the-top-10-nations-buying-gold-a-portfolio-strategy-you-can-follow/

9 https://www.equinoxgold.com/presentations/

10 https://www.equinoxgold.com/presentations/

11 https://www.equinoxgold.com/presentations/

12 https://www.equinoxgold.com/reserves-and-resources/

13 https://www.equinoxgold.com/presentations/

14 https://www.marketscreener.com/quote/stock/EQUINOX-GOLD-CORP-45205597/news/Equinox-Gold-Corp-completed-the-acquisition-of-remaining-40-stake-in-Greenstone-Gold-Mines-GP-Inc-46721877/

15 https://www.equinoxgold.com/presentations/

16 https://www.equinoxgold.com/our-mines/valentine/

17 https://resourceworld.com/central-newfoundland-gold-belt-becoming-major-gold-camp/

18 https://www.equinoxgold.com/presentations/

19 https://www.equinoxgold.com/reserves-and-resources/

20 https://www.equinoxgold.com/our-mines/valentine/

21 https://www.equinoxgold.com/our-mines/valentine/

22 https://www.equinoxgold.com/wp-content/uploads/2025/06/20250210-Calibre-Valentine-Gold-Frank-Zone-Exploration-Drill-Results-News-Release-Final.pdf

23 https://www.equinoxgold.com/our-mines/valentine/

24 https://www.canadianminingjournal.com/news/calibre-mining-expands-gold-mineralization-at-valentine-gold-mine/

25 https://www.equinoxgold.com/our-mines/valentine/

26 https://www.permitting.gov/press-releases/castle-mountain-mine-phase-2-project-latest-gain-fast-41-coverage

27 https://www.equinoxgold.com/growth-projects/castle-mountain-expansion/

28 https://www.equinoxgold.com/growth-projects/castle-mountain-expansion/

29 https://www.equinoxgold.com/leadership-team/

30 https://www.equinoxgold.com/wp-content/uploads/2025/06/20250210-Calibre-Valentine-Gold-Frank-Zone-Exploration-Drill-Results-News-Release-Final.pdf

31https://finance.yahoo.com/quote/PAAS/

32 https://www.equinoxgold.com/leadership-team/

33 https://www.equinoxgold.com/leadership-team/

34 https://www.equinoxgold.com/leadership-team/

35 https://www.equinoxgold.com/investors/

IMPORTANT NOTICE AND DISCLAIMER

This article is a paid advertisement. Think Ink Marketing and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by profiled companies or third parties to organize marketing campaigns, which include the creation and dissemination of these types of communications. In this case, in an effort to enhance public awareness of for Equinox Gold Corp. (“EQX”) and its securities, EQX has provided the Publisher with a budget of approximately $210,000 USD to cover the costs associated with the creation and distribution of this communication. The Publisher may retain any excess sums after expenses as its compensation. This compensation should be viewed as a major conflict with our ability to be unbiased. Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur. This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by EQX) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP.

The Publisher does not own any shares of EQX and has no information concerning share ownership by others of in EQX. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

FORWARD LOOKING STATEMENTS.

This publication contains forward-looking statements, including statements regarding expected continual EQXwth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to EQX’s industry; (b) market opportunity; (c) EQX’s business plans and strategies; (d) services that EQX intends to offer; (e) EQX’s milestone projections and targets; (f) EQX’s expectations regarding receipt of approval for regulatory applications; (g) EQX’s intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) EQX’s expectations regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute EQX’s business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) EQX’s ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) EQX’s ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) EQX’s ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of EQX to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) EQX operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact EQX’s business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing EQX’s business operations (e) EQX may be unable to implement its EQXwth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

INDEMNIFICATION/RELEASE OF LIABILITY.

By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

INTELLECTUAL PROPERTY.

Think Ink Marketing is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Tycona Media Ltd. Articles appearing on this website should be considered paid advertisements. Tycona Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

The Website Host has been paid approximately $500 per month while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling Equinox Gold Corp. (“EQX”).

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled compannies and has no information concerning share ownership by others of any profiled companies. The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of EQX or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about EQX Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in EQX’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Tomorrow Investor is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding EQX’s future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to EQX’s industry; (b) market opportunity; (c) EQX’s business plans and strategies; (d) services that EQX intends to offer; (e) EQX’s milestone projections and targets; (f) EQX’s expectations regarding receipt of approval for regulatory applications; (g) EQX’s intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) EQX’s expectations regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute EQX’s business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) EQX’s ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) EQX’s ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) EQX’s ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of EQX to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) EQX’s operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact EQX’s business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing EQX’s business operations (e) EQX may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of EQX or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of EQX or such entities and are not necessarily indicative of future performance of EQX or such entities.

STOCK INFORMATION

Symbols: (TSX: EQX, NYSE-A: EQX)

RELATED NEWS