- Commodities

- October 5, 2025

- Editorial Feature

- Download Printable Version

BREAKTHROUGH DISCOVERY OF ULTRA-RARE NICKEL ALLOY IN THE ATLANTIC

First Atlantic Nickel (OTC: FANCF | TSXV: FAN) discovers Awaruite (Ni₃Fe) - earth's highest grade nickel mineral. This rare stainless steel-like, nickel-iron alloy could help eliminate the smelter bottleneck and onshore America's critical mineral supply chain.

The United States of America faces a critical nickel crisis – it has only one operating nickel mine in Michigan, anticipated to exhaust it’s production in 2025.1 That mine produces concentrate that must be exported for processing since the US has no domestic nickel smelters or refineries capable of processing nickel-bearing concentrates.

First Atlantic Nickel (OTC: FANCF | TSXV: FAN.V) has made the first major drilled discovery of awaruite in the Atlantic in 30 years. The USGS has identified this ultra-rare mineral as a solution to nickel shortages in their 2012 annual report on nickel2. The USGS recognized awaruite’s potential because it’s dramatically easier to process and concentrate than sulfide nickel. Crucially, it also doesn’t require smelting – eliminating the need for the infrastructure America lacks.

First Atlantic’s large-scale discovery could provide a reliable and secure nickel source for America because awaruite – a naturally occurring magnetic nickel-iron-cobalt alloy that’s like naturally occurring stainless steel – can be processed using simple magnetic and gravity separation techniques. This bypasses the need for complex smelting operations.

First Atlantic’s groundbreaking nickel and chromium discovery could be the largest in the Atlantic in more than 30 years. Awaruite is the highest-grade nickel alloy mineral on Earth at ~77% pure nickel3 with cobalt and iron, making it dramatically easier to process than traditional nickel sulfide. The discovery spans a massive 30-kilometer ophiolite – almost 50% longer than all of Manhattan, NY – a huge chunk of the ocean floor enriched in nickel, chromium and cobalt thrust up on the continental margin.

The last major nickel discovery in the Atlantic was Voisey’s Bay. Diamond Fields Resources was trading at $4.65 in November 1994, then hit $804 by June 1995 – a spectacular 17-fold increase. Inco (now Vale) ultimately acquired the mine for $4.3 billion5. That mine became so strategically important that Tesla signed an offtake deal in 20226 to supply its American gigafactories.

This discovery comes at a critical moment. Despite surging demand from EVs and renewable energy, with the International Energy Agency and Fraser Institute predicting 60 new nickel mines are needed by 2030. As global demand doubles from 3 to 6 million tons, North America remains dangerously unprepared to meet these needs.

America’s sole operating nickel mine produces less than 1% of nickel annually7 and is anticipated to exhaust its production by the end of 20258. Critically, the United States has no nickel smelters to process mined nickel ore – a severe national security risk and single point of failure in the critical mineral supply chain. Meanwhile, China effectively controls half of the world’s nickel supply and up to 80% of global nickel processing9 through its Belt and Road Initiative in Indonesia.

In 2022, the US government added nickel to its Critical Minerals List10, recognizing its vital importance. The Energy Act of 2020 defined critical minerals as:

- Those that are essential to the economic or national security of the United States

- Have a supply chain that is vulnerable to disruption

- And serve an essential function in the manufacturing of a product, the absence of which would have significant consequences for the economic or national security of the U.S.11

Nickel meets all these criteria through its critical manufacturing functions in stainless steel, superalloys, and rechargeable batteries.

With the White House proclaiming critical minerals as the “gold rush of the 21st century” in March 202512 and nickel sitting at the top of the US Government’s critical minerals list13,14, this discovery couldn’t come at a more crucial time.

First Atlantic Nickel’s (OTC: FANCF | TSXV: FAN.V) discovery represents a potential game-changer – a large scale source of nickel that doesn’t need a smelter to process, at near perfect timing when the mining and processing of critical minerals are controlled by geopolitical rivals.

Watch the video above to see how this rare awaruite discovery could transform the North American nickel supply chain.

Investors seeking to learn more about this breakthrough discovery and how First Atlantic Nickel is positioning itself to become North America’s next large-scale smelter-free nickel source are encouraged to phone the company’s investor relations team at 844-592-6337 or email [email protected]. First Atlantic Nickel shares are accessible through numerous online brokerage firms under the stock symbols $FANCF on OTC Markets in the US and $FAN.V on the TSX Venture Exchange in Canada.

EXPONENTIAL DEMAND GROWTH CREATING UNPRECEDENTED NICKEL SUPPLY CRISIS

According to the Nevada Bureau of Mines and Geology (NBMG), batteries currently represent just 3% of nickel consumption15 while stainless steel dominates at 72%, followed by non-ferrous alloys (9%), alloy steels and casting (9%), plating (8%), and other uses (1%). Yet battery demand is projected to become the fastest growing sector through this decade and beyond, fundamentally reshaping the nickel market.

The Critical Supply-Demand Imbalance

- Global nickel demand to double from 3 to 6+ million tons by 2040 (IEA)16

- 60 new nickel mines needed by 2030 per IEA and Fraser Institute17

- 40X growth in EV battery nickel demand by 204018

- 140X surge for grid batteries storing clean energy and powering AI data centers19

Tesla’s Requirements Expose the Scale

The crisis becomes clear through Tesla’s operations. Running at current 35 GWh capacity, their Sparks Nevada Gigafactory producers 500,000 vehicles annually, requiring 26,250 tons of nickel.20 That’s more than 3X all US production. Michigan’s Eagle Mine produced just 8,000 tons in 2024.21

This single gigafactory consumes 7X more nickel than lithium (3,885 tons) and 8X more nickel than cobalt (3,290 tons)22, validating Elon Musk’s observation that Tesla’s batteries should be called “Nickel-Graphite” rather than lithium-ion.

Scaling up reveals staggering requirements. Expanding Sparks Gigafactory to meet Tesla’s goal of 500 GWh could demand 375,000 tons annually – 47X all US mined nickel supply. Tesla’s 2030 goal of 20 million vehicles, accelerated by robotaxi and Semi truck production, could require 1.05 million tons of nickel annually – equivalent to output from 25 average-sized nickel mines (42,000 tons per year).

Beyond Batteries: Aerospace’s Nickel Dependency

SpaceX’s Starship demonstrates nickel’s broader critical role. It uses high nickel-chrome 304L stainless steel that gains 50% strength at -270°C space temperatures while withstanding re-entry heat. This alloy prevents brittleness at extreme cold while reducing weight—enabling hour-long turnarounds for reusability23. Similarly, jet turbine blades with 50% nickel content endure 1,650°C temperatures, underscoring nickel’s irreplaceable role in extreme aerospace applications24.

“I’d just like to re-emphasize, any mining companies out there, please mine more nickel. Tesla will give you a giant contract for a long period of time, if you mine nickel efficiently and in an environmentally sensitive way.”25

~ Elon Musk

THE PROBLEM: US HAS NO NICKEL SMELTERS, ONLY NICKEL MINE CLOSES 2025, NO CHROMIUM MINING SINCE 1962

The United States faces a catastrophic nickel vulnerability with zero domestic smelters capable of processing nickel ore. America’s only operating nickel mine in Michigan will close in 2025 and produces just 8,000 tons annually out of 3.7 million tons mined globally—less than 1% of global production. This minimal production must be exported out of the country for processing. The US cannot even import nickel ore from other nations because it lacks any processing infrastructure to convert raw ore into usable nickel.

The US hasn’t mined chromium—a DOD critical mineral essential for stainless steel and defense applications—since 1962, with zero active mines in North America despite a 47 million ton annual global market. The Department of Defense considers chromium so strategic it maintains a 920-tonne ferrochromium stockpile. Common stainless steel contains double the chromium than nickel. Per USGS: “Chromium has no substitute in stainless steel, the leading end use, or in superalloys, the major strategic end use.”

Barrick Gold CEO: “The challenge for the US is smelting capacity, it’s all spoken for. The country needed more domestic smelters if it really wanted to reduce its dependence on imports of metal from China.” – Financial Times

Many fatal barriers prevent the US developing a domestic nickel mining and processing industry. Most US nickel resources are sulfide deposits that create Acid Mine Drainage (AMD) when exposed to air and water, producing sulfuric acid that contaminates water systems. AMD has been called the mining industry’s greatest environmental impact, especially to our waterways. Alaska’s Pebble Mine was denied permits after a decade of attempts, with water contamination from AMD being a factor in the denial.

Nickel smelters would be near impossible to permit in the US, facing multiple barriers. They emit toxic SO₂ gases and particulates causing respiratory diseases and acid rain. Environmental regulations and energy prices are major roadblocks to building profitable smelters.26 The US has historically relied on Canadian nickel imports from Sudbury, but those mines face depleting reserves. Canadian environmental standards have resulted in smelter closures and operational challenges, while communities in Canadian mining towns have opposed building new smelters due to health concerns.

Reuters reported in May 2025 in an article titled “US aluminum smelters vie with Big Tech for scarce power” that “High power prices killed off most of the country’s smelters and a lack of competitively priced power has deterred anyone from building one since the last century.” Electricity costs are a major barrier to building new smelters in the US, where American electricity prices can far exceed the costs of burning coal in Indonesia for electricity to power smelters.27

CHINA'S STRATEGIC TAKEOVER OF GLOBAL NICKEL

China executed a methodical takeover of the global nickel supply chain. In 2012, Hong Kong Exchanges acquired the London Metals Exchange where global nickel prices are set. Following the 2013 Belt and Road Initiative launch, China capitalized when Indonesia banned raw ore exports in 2020, with Chinese companies committing $30 billion in investments, much backed by state banks and Belt and Road funding. Indonesia became Belt and Road’s single biggest recipient in 2023, receiving $7.3 billion largely directed at nickel.

Today, Chinese companies control 90% of Indonesia’s nickel processing through 43 operating smelters with 28 under construction. China has designated major nickel projects as National Strategic Projects (NSP), granting them special police and military protection. These operations achieve costs impossible under Western standards by dumping acidic waste into oceans, using coal-fired power, and employing practices that resulted in dozens of worker deaths. In September 2024, the US Department of Labor added Indonesian nickel to its list of goods produced by child and forced labor.

Indonesia produces 60% of global nickel supply—essentially controlled by China through systematic investment and infrastructure development. The Financial Times dubbed this arrangement the “OPEC of nickel.”

China has already weaponized critical minerals through graphite export restrictions and rare earth export controls, demonstrating its willingness to leverage mineral dominance for geopolitical advantage. With near-total control of global nickel processing, China could restrict nickel exports at any moment, crippling Western defense and clean energy sectors.

Against this backdrop of Chinese monopoly control and America’s complete vulnerability, First Atlantic’s nickel discovery represents a critical opportunity to break free from foreign dependence and onshore nickel production before it’s too late.

“There is no adequate alternative supply of nickel produced outside of China or by non-Chinese companies.”

THE SOLUTION: FIRST ATLANTIC'S BREAKTHROUGH DISCOVERY OF AWARUITE (NI₃FE), A RARE, HIGH-GRADE, NATURAL NICKEL ALLOY THAT BYPASSES THE NEED FOR SMELTING

“The development of awaruite deposits in other parts of Canada may help alleviate any prolonged shortage of nickel concentrate. Awaruite, a natural iron-nickel alloy, is much easier to concentrate than pentlandite, the principal sulfide of nickel.”

The United States Geological Survey identified awaruite (Ni₃Fe) as a potential solution back in 2012, yet no significant drilled discoveries occurred until now. This ultra-rare, naturally magnetic alloy contains approximately 77% nickel, 21% iron, and 1% cobalt28.

As a natural nickel alloy, awaruite bypasses the typical secondary processing required for nickel sulfides and laterites – smelting, roasting, or high pressure acid leaching. These energy-intensive, costly methods carry severe environmental risks from emissions and acidic tailings.

Instead, awaruite processing uses magnetic separation with simple flotation to produce ~60% nickel concentrate29 – more than 4X the grade of typical nickel sulfide concentrates. Compare that to the 14% nickel concentrate30 from Michigan’s Eagle Mine, America’s only operating nickel mine.

This high-grade concentrate delivers four times more nickel per ton, making shipping more economic while eliminating overseas smelter dependence and the associated treatment and refining charges.30 The process employs proven technology from North American iron mines like Cliffs Natural Resources in Minnesota.31 It also uses significantly less electricity and creates a cleaner environmental footprint that streamlines permitting.

UNPRECEDENTED NICKEL-CHROMIUM DISCOVERY IN THE ATLANTIC: 30KM OPHIOLITE COMPLEX FROM EARTH'S MANTLE ENRICHED IN AWARUITE

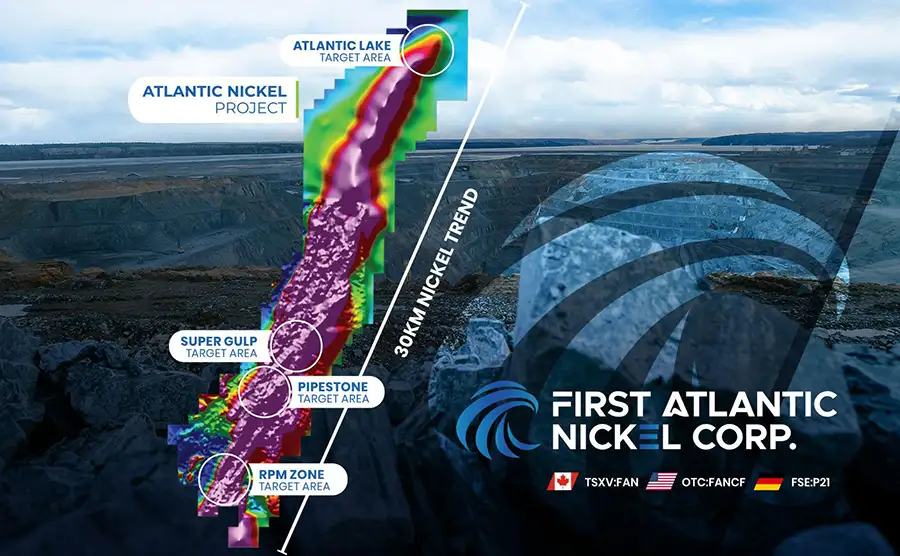

First Atlantic owns 100% of the Atlantic Nickel Project, encompassing the entire Pipestone Ophiolite Complex – a 30-kilometer belt of ultramafic rocks within the ancient Appalachian mountain belt. This 489-million-year-old section of ocean floor was thrust onto the continental margin during the formation of the Appalachian Mountains that run down eastern North America.

The ultramafic rocks formed deep in Earth’s mantle represent some of the most nickel-enriched geology on the planet. Through serpentinization – where water interaction over millions of years triggered chemical reactions requiring hydrogen – these rocks formed the ultra-rare awaruite nickel-iron-cobalt alloy (~77% nickel33) along with significant chromite mineralization. Unlike traditional sulfide nickel requiring smelters, awaruite formed as a natural alloy – essentially pure metal, pre-processed by nature itself.

The serpentinization process that creates awaruite also generates significant hydrogen gas.This has attracted attention from the Colorado School of Mines – one of America’s top-ranked geology schools with Department of Energy ARPA-E funding for geologic hydrogen research. They’ve partnered with First Atlantic to investigate this potential clean energy breakthrough in these ophiolites. During serpentinization, iron oxidizes and water reduces to liberate molecular hydrogen (H₂), which could provide an abundant, low-cost clean energy source with the USGS and DOE targeting production costs below $1 per kilogram – potentially disrupting traditional hydrocarbons and far undercutting the $5-7 per kilogram typical for green hydrogen production.

FIRST ATLANTIC'S CLUSTER OF AWARUITE DISCOVERIES: MULTIPLE NICKEL-CHROMIUM ZONES ACROSS 30-KILOMETER OPHIOLITE COMPLEX

First Atlantic Nickel’s discovery of awaruite is a potential game-changer in the race to secure reliable, large-scale sources of critical minerals that can be domestically processed. The company has transformed from a junior explorer into the owner of what could become the continent’s first smelter-free nickel mining district.

Surface sampling dating back to the 1980s showed elevated nickel, chromium and cobalt across this magnetic trend, with over 8,900 historical samples compiled, including 4,600 samples showing elevated nickel values across the 30-kilometer core area. Prior companies weren’t aware of awaruite’s significance and did not identify the source of the nickel anomalies.

Building on decades of overlooked potential, the company’s transformation began in winter 2024 when it rebranded and acquired the entire 30-kilometer ophiolite complex. This brought unique advantage – the company’s geologist had completed his 2012 university thesis on this exact project titled “An Examination of Awaruite (Ni₃Fe) Formation During Serpentinization of the Pipestone Pond Ophiolitic Complex”.

In summer 2024, First Atlantic’s project geologists conducted regional exploration across the entire 30-kilometer trend of nickel and chromium bearing ultramafic rocks, discovering large grains of visible awaruite at the surface that led to the RPM discovery.

The RPM Zone is a brand-new discovery 30 kilometers south of historic Atlantic Lake drilling where short holes had accidentally discovered nickel decades ago, though previous explorers were unaware of awaruite’s existence. Today, every single RPM hole has hit continuous, consistent grades.

Phase 2 results delivered 447.35 meters – more than a quarter mile – with all holes ending in mineralization, indicating size potential even greater than reported.

All six RPM holes returned high-grade magnetic concentrates with nickel, chromium, and cobalt, averaging 1.38% nickel and 1.67% chromium, with peaks reaching 2.35% nickel and 8.17% chromium.

This consistency, achieved through simple magnetic separation with high recovery rates and mass pull under 10%, means 90% of material is discarded as waste rock early in the process.

This waste rock is non-acid generating and contains brucite34 that can capture carbon, creating an environmentally safe and sustainable mine with clean processing, no smelting, and significantly lower electricity requirements.

While current drilling has proven a 400×500 meter area at RPM with numerous pending holes that could expand these dimensions, the RPM Zone represents just a fraction of the size potential. The true prize is the 30-kilometer strike length of nickel-bearing ultramafic rocks containing awaruite and chromium running from RPM north to Atlantic Lake. This could develop into a multi-pit mining district with RPM alone having potential for 1 billion tons – close to 6 billion pounds of nickel.

The project’s critical minerals include chromium averaging 1.67% in concentrate – vital for stainless steel with zero current North American production – plus cobalt. Ultra-low impurities make this ideal for direct steel mill feed or EV battery refineries, eliminating North America’s nickel processing bottleneck.

Direct road access and hydroelectric power with excess capacity are available to support the project’s development. Plus, Newfoundland’s pro-mining jurisdiction has approved drilling permits in just three weeks. Critically, Newfoundland doesn’t have First Nations with land rights – a major hurdle elsewhere in Canada and the US – making it a unique mining jurisdiction in North America that removes significant permitting obstacles.

Market observers note First Atlantic’s favorable financing from an anonymous strategic corporate partner, including above-market price financings and unsecured loans deferring interest for five years.

Awaruite is so rare that even major mining companies and ultramafic rock specialists are unfamiliar with it – another reason to stay anonymous.

Disclosure could trigger a bidding war for this discovery that can be fully processed on-site with a complete North American supply chain for nickel, chromium, and cobalt – minerals designated critical by the US, Canada, European Union, and Japan.

FIRST ATLANTIC NICKEL: UNLOCKING A PURE DOMESTIC RESILIENT CRITICAL MINERALS SUPPLY CHAIN

For the United States to successfully reshore its manufacturing and dominate the development and production of future technologies – from EVs to battery manufacturing – it requires a resilient critical mineral supply chain. This means securing reliable, onshore sources of critical minerals, with nickel at the top of the Department of Energy’s list due to its high risk from energy, national security, and supply chain disruption vulnerabilities.

The company’s 30-kilometer trend of high-grade awaruite could provide the secure, reliable nickel and chromium supply that reshoring American manufacturing demands – without the need for a single new smelter.

First Atlantic Nickel OTC: FANCF | TSXV: FAN

Investor Spotlight: First Atlantic Nickel

Investors seeking to connect with or learn more about First Atlantic Nickel’s exciting developments are encouraged to speak with their investor relations team directly at 844-592-6337 or [email protected].

First Atlantic Nickel’s shares are listed under stock symbol $FANCF on OTC Markets in the US (DTC eligible). The company also trades under $FAN on the TSX Venture Exchange in Canada and P21 on German exchanges including Frankfurt and Tradegate, making the stock readily accessible through numerous brokerage firms worldwide.

Start Tracking First Atlantic Nickel $FANCF- Add It To Your Watch List Today!

1 https://www.crugroup.com/en/communities/thought-leadership/2024/impact-of-us-tariffs-on-canadian-nickel-industry/

2 https://d9-wret.s3.us-west-2.amazonaws.com/assets/palladium/production/mineral-pubs/nickel/mcs-2012-nicke.pdf

3 https://open.library.ubc.ca/soa/cIRcle/collections/ubctheses/24/items/1.0430333

4 https://www.visualcapitalist.com/the-story-of-voiseys-bay-the-auction-part-2-of-3/

5 https://www.visualcapitalist.com/the-story-of-voiseys-bay-todays-mine-part-3-of-3/

6 https://vale.com/w/vale-confirms-supply-deal-with-tesla-for-low-carbon-nickel

7 https://pubs.usgs.gov/periodicals/mcs2024/mcs2024-nickel.pdf

8 https://www.crugroup.com/en/communities/thought-leadership/2024/impact-of-us-tariffs-on-canadian-nickel-industry/

9 https://www.bloomberg.com/news/articles/2024-05-01/us-philippines-eye-partnership-to-cut-china-s-nickel-dominance

10 https://www.usgs.gov/news/national-news-release/us-geological-survey-releases-2022-list-critical-minerals

11 https://www.usgs.gov/news/national-news-release/us-geological-survey-releases-2022-list-critical-minerals

12 https://www.whitehouse.gov/fact-sheets/2025/03/fact-sheet-president-donald-j-trump-takes-immediate-action-to-increase-american-mineral-production/

13 https://www.federalregister.gov/documents/2022/02/24/2022-04027/2022-final-list-of-critical-minerals

14 https://www.energy.gov/sites/default/files/2023-07/doe-critical-material-assessment_07312023.pdf

15 https://mmsa.net/wp-content/uploads/2024/01/Jowitt-MMSA-Webinar-January-2023-v2_nohide.pdf

16 https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions/mineral-requirements-for-clean-energy-transitions

17 https://www.fraserinstitute.org/studies/can-metal-mining-match-speed-planned-electric-vehicle-transition

18 https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions/mineral-requirements-for-clean-energy-transitions

19 https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions/mineral-requirements-for-clean-energy-transitions

20 https://mmsa.net/wp-content/uploads/2024/01/Jowitt-MMSA-Webinar-January-2023-v2_nohide.pdf

21 https://pubs.usgs.gov/periodicals/mcs2025/mcs2025-nickel.pdf

22 https://mmsa.net/wp-content/uploads/2024/01/Jowitt-MMSA-Webinar-January-2023-v2_nohide.pdf

23 https://worldsteel.org/media/steel-stories/innovation/spacex-relies-on-stainless-steel-for-starship-mars-rocket/

24 https://www.rrutc.msm.cam.ac.uk/outreach/articles/metals-up-close/turbine-blade-nickel-superalloy

25 https://electrek.co/2020/07/23/tesla-tsla-elon-musk-nickel-people/

26 https://www.canada.ca/en/environment-climate-change/services/canadian-environmental-protection-act-registry/publications/code-practice-base-metals-smelters/summary.html

27 https://www.canarymedia.com/articles/clean-aluminum/us-manufacturing-power-challenges

28 https://open.library.ubc.ca/soa/cIRcle/collections/ubctheses/24/items/1.0430333

29https://fpxnickel.com/news/fpx-nickel-scoping-study-outlines-development-of-worlds-largest-integrated-nickel-sulphate-operation-for-ev-battery-supply-chain-at-baptiste-project-in-british-columbia/

30https://lundinmining.com/news/lundin-mining-announces-commercial-production-at-e-122582/

31 https://www.canadianminingjournal.com/featured-article/what-miners-need-to-know-about-smelter-charges/

32 https://www.clevelandcliffs.com/operations/steelmaking/iron-ore-facilities

33 https://open.library.ubc.ca/soa/cIRcle/collections/ubctheses/24/items/1.0430333

34 https://academic.oup.com/petrology/article/63/11/egac100/6747305

IMPORTANT NOTICE AND DISCLAIMER

This article is a paid advertisement. Think Ink Marketing and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by profiled companies or third parties to organize marketing campaigns, which include the creation and dissemination of these types of communications. In this case, in an effort to enhance public awareness of First Atlantic Nickel Corp.(“FAN”) and its securities, FAN has provided the Publisher with a budget of approximately $500,000.00 USD to cover the costs associated with the creation and distribution of this communication. The Publisher may retain any excess sums after expenses as its compensation. This compensation should be viewed as a major conflict with our ability to be unbiased. Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur. This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by FAN) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP.

The Publisher does not own any shares of FAN and has no information concerning share ownership by others of in FAN. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

FORWARD LOOKING STATEMENTS.

This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to FAN’s industry; (b) market opportunity; (c) FAN’s business plans and strategies; (d) services that FAN intends to offer; (e) FAN’s milestone projections and targets; (f) FAN’s expectations regarding receipt of approval for regulatory applications; (g) FAN’s intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) FAN’s expectations regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute FAN’s business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) FAN’s ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) FAN’s ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) FAN’s ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of FAN to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) FAN operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact FAN’s business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing FAN’s business operations (e) FAN may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

INDEMNIFICATION/RELEASE OF LIABILITY.

By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

INTELLECTUAL PROPERTY.

Think Ink Marketing is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Tycona Media Ltd. Articles appearing on this website should be considered paid advertisements. Tycona Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling First Atlantic Nickel Corp.(“FAN”).

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled companies and has no information concerning share ownership by others of any profiled companies. The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of FAN or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about FAN Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in FAN’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Tomorrow Investor is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding FAN’s future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to FAN’s industry; (b) market opportunity; (c) FAN’s business plans and strategies; (d) services that FAN intends to offer; (e) FAN’s milestone projections and targets; (f) FAN’s expectations regarding receipt of approval for regulatory applications; (g) FAN’s intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) FAN’s expectations regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute FAN’s business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) FAN’s ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) FAN’s ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) FAN’s ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of FAN to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) FAN’s operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact FAN’s business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing FAN’s business operations (e) FAN may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of FAN or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of FAN or such entities and are not necessarily indicative of future performance of FAN or such entities.

COMPANY SPOTLIGHT

TSX:FAN | OTC:FANCF

INVESTOR RELATIONS

Email: [email protected]

Tel: 844-592-6337

LATEST NEWS

Why Investors Are Eyeing First Atlantic