- COMMODITIES

- September 7, 2025

- Editorial Feature

Golden Dome Initiative Marks the Next Era of U.S. Defense Strategy

The Largest Infrastructure Project in U.S. History

The White House has committed $175 billion to secure North America’s skiesi , a buildout that will require vast new supplies of critical minerals.

Formation Metals (CSE: FOMO, OTC: FOMTF) is advancing projects with 877,000 oz. of gold already defined, plus exposure to titanium, nickel, copper, and cobalt.

The United States is embarking on its most ambitious infrastructure project in history.

Bigger than the Interstate Highway System. Bigger than the satellite networks that defined modern communications and global surveillance. This new era is defined by control of space.

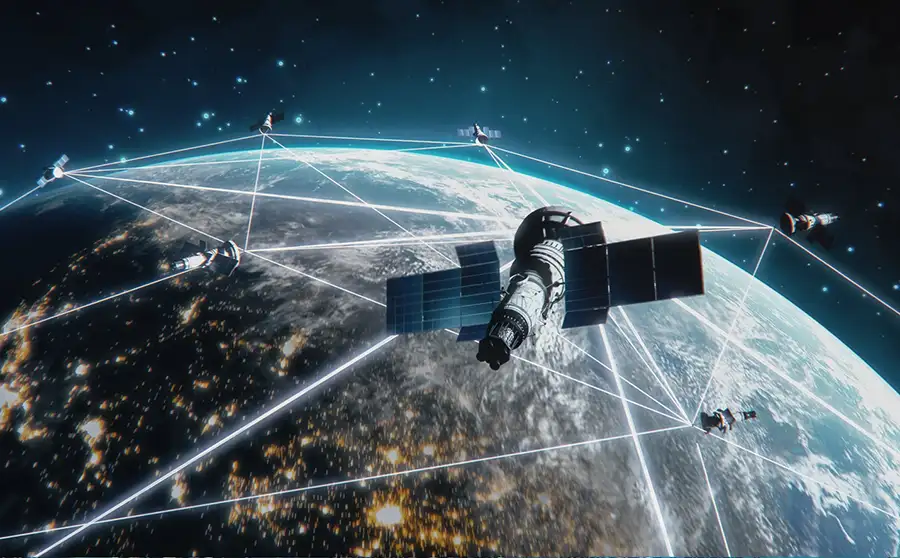

At its core are two monumental initiatives that will guide the defense infrastructure of the future. The first is the Golden Dome missile defense shield, similar in scope to Israel’s Iron Dome, but scaled to protect all of North America.ii

The second is the creation of a new U.S. Space Command headquarters.iii The urgency of which could not come fast enough, as Secretary of Defense Pete Hegseth warned at a recent press briefing:

“Whoever controls the skies, will control the future of warfare.” iv

The Golden Dome will ensure this power remains in North American hands.

This unprecedented, multi-layered missile defense system will combine satellites, ground-based sensors, and interceptor networks deployed across land, sea, and space.

Announced in January, the full buildout is projected to cost $175 billion and be operational within three years. But before the shield can rise, the foundation must be set. And that’s coming in the form of a new U.S. Space Command headquarters in Huntsville, Alabama.v

Coordinating this massive network will require a central command node, and Huntsville has been chosen to play a central role. That’s not surprising, given the region’s long history as a hub for aerospace innovation.

As home to NASA’s Marshall Space Flight Center, Huntsville has supported decades of rocket design, missile defense development, and space exploration.vi Now, it will become the headquarters for America’s most strategic defense system.

The announcement sent ripples through markets. Defense stocks rallied, analysts raced to model the implications, and Washington emphasized the speed of the buildout. Yet one crucial piece of the story has been largely overlooked.

Turning this vision into reality will require an inordinate amount of materials.

Every satellite, every interceptor, every command system relies on resources mined from the earth. From the copper that powers data centers, to the titanium that strengthens fighter jets, these resources have become the foundation of economic growth, national defense, and technological progress.

Even gold, long seen as a financial anchor, is now indispensable to advanced electronics, semiconductors, and next-generation defense technologies.vii

And while demand continues to rise for these strategic materials, securing domestic supply chains remains a pressing challenge. Nations are scrambling to secure access. Corporations are racing to lock in contracts. And the market is searching for companies positioned to fill the gap.

Formation Metals (CSE: FOMO, OTC: FOMTF) is one to watch. With nearly 900,000 ounces of gold defined and projects advancing in titanium, nickel, and cobalt, the company is positioned squarely in the path of rising demand.

And it all starts with gold – the original store of value, now rediscovered as a strategic metal for the modern age.

877,000 Ounces of Gold in the Ground, On The Path To Expansion

Gold is in the middle of a historic rally.

Prices have surged above $3,500 per ounce, up more than 85% since January 2022.viii And analysts now forecast levels as high as $4,000 by mid-2026.ix Meanwhile, central banks are buying at record levels, consistently adding more than 1,000 metric tons per year.x

But gold today is more than a financial hedge. Its unique properties – exceptional conductivity, corrosion resistance, and reflectivity – make it indispensable to satellites, aerospace systems, and advanced defense electronics.

Every satellite in orbit, including those that will anchor the Golden Dome, relies on gold plating and circuitry to function in extreme environments.

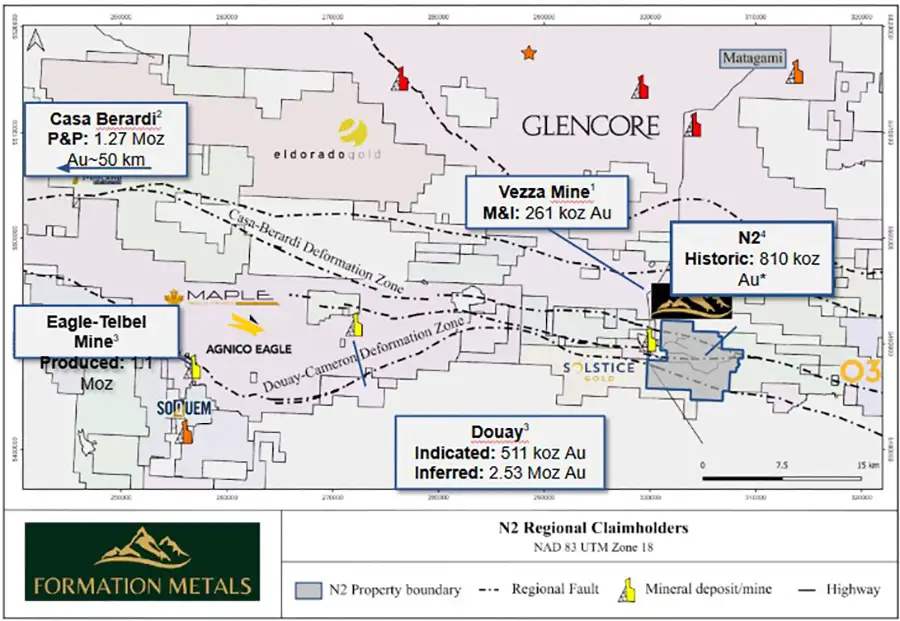

That brings us to Formation Metals (CSE: FOMO, OTC: FOMTF) and its flagship N2 Project, boasting a historic resource of 877,000 ounces of gold. It’s a substantial discovery, and not surprising given its location.

The project sits in Canada’s Abitibi Greenstone Belt, one of the world’s most prolific gold regions, with more than 200 million ounces of past production.xi

N2 is surrounded by proven success: Hecla’s Casa Berardi mine, Agnico Eagle’s historic Eagle-Telbel operation (which produced 1.1 million ounces at 6.5 g/t), and Maple Gold’s Douay project, a district-scale development to the south.xii In this neighborhood, world-class deposits are widespread.

And N2’s own history backs up that potential. Historic drilling returned gold in 70–80% of holes, underscoring the continuity of mineralization and its expansion potential. Historically, over 18 million tonnes at a grade of ~1.48 g/t was identified across multiple zones, including the high-grade RJ Zone averaging ~7.82 g/t with results as high as 51 g/t over 0.8 metres.

The company is now advancing to unlock its full potential. In 2025, Formation launched a 20,000-metre, multi-phase drill program to modernize and expand the resource. Backed by a $5.7 million fully funded budget, rigs are already turning on an initial 10,000-metre campaign.

With assays pending, investors can expect a steady stream of news catalysts in the near term, results that could quickly redefine the scale of N2.

Unlike many early-stage explorers, N2 benefits from real infrastructure: year-round road access, grid power, and a skilled local workforce. These advantages have the potential to lower costs and accelerate development.

And gold is only the beginning. Formation Metals (CSE: FOMO, OTC: FOMTF) is also advancing projects in Quebec and Ontario with exposure to titanium, nickel, copper, and cobalt, metals equally vital to defense, aerospace, and the manufacturing boom.

The Same System as the World’s Largest Titanium Mine

While gold enables the circuitry of the modern defense system, titanium protects it. Fighter jets, missile systems, armor plating, submarines, and satellites all rely on titanium’s unique combination of strength, light weight, and corrosion resistance. In fact, about one-third of the weight of the F-35 Lightning II jet is titanium.xiii

Not surprisingly, titanium demand is accelerating at an unprecedented rate.

Market size is projected to climb from $28 billion in 2024 to as much as $53 billion by 2034, a compound annual growth rate of 6.5%.xiv Defense and aerospace remain the primary drivers, underpinned by a U.S. defense budget now exceeding $1 trillion annually.xv

Securing supply has become a strategic imperative. Washington has formally designated titanium a critical mineral, underscoring its importance to national security.xvi

That’s where Formation Metals (CSE: FOMO, OTC: FOMTF) is in a unique position.

The company’s Rio Project covers over 4,300 hectares in Quebec and sits directly adjacent to Rio Tinto’s Lac Tio mine, the largest operating titanium mine in the world. Lac Tio is a geological anomaly, producing ore with high titanium concentrations since the 1950s.xvii

Geological surveys confirm that the same magnetic anomaly feeding Lac Tio extends into Formation’s property. This gives the Rio Project a direct line of continuity to one of the world’s richest and longest-running titanium systems.

Infrastructure only adds to its value. The project is accessible by road, close to rail, and benefits from Quebec’s abundant low-cost hydroelectric power. All elements that have the potential to reduce costs and improve the economics of future development.

Exploration here is still at an early stage, which is precisely what makes it so compelling. In the mining industry, it is often these early discovery and resource-definition phases where the greatest value creation tends to occur.

Analysts illustrate this dynamic with the “Lassonde Curve,” a framework showing how projects typically see their steepest growth as exploration advances and resources are proven.xviii

Formation’s Rio Project is situated in that window today: strategically located, geologically validated, and now beginning the work that can reveal its true scale.

Unlocking A New Source of Copper, Nickel, Cobalt, and Platinum for The Modern Tech Boom

As the Golden Dome and Space Command move into construction, unprecedented volumes of industrial metals will be required. Copper for wiring. Nickel for stainless steel. Cobalt and platinum for advanced alloys and precision components.

Consider copper. The grid upgrades, satellites, and command infrastructure tied to this initiative will demand millions of pounds of copper wiring to transmit power and data reliably. The UN has already warned of a looming supply gap as demand outpaces new mine development.xix

Nickel plays an equally critical role. More than two-thirds of nickel demand today is tied to stainless steelxx, essential for aerospace, naval systems, defense vehicles, and industrial infrastructure. As defense spending surges past $1 trillion annually, stainless steel demand is set to climb in parallel, placing nickel squarely in the spotlight. Forecasts call for nickel demand to double or even triple by 2030.xxi

Cobalt, often produced as a by-product of nickel and copper, is expected to rise in tandem. It is used in hardened alloys for defense systems and electronic devices. Then there’s platinum, which has critical applications in aerospace components and catalysts.

This rapidly escalating demand calls for projects with a proven track record. And that’s where Formation Metals (CSE: FOMO, OTC: FOMTF) Nicobat Project in Quebec enters the picture.

Exploration at the Nicobat property dates back to the early 1950s, when Noranda Exploration first identified nickel mineralization in 1952. Over the following two decades, a series of companies carried out extensive drilling campaigns, ultimately completing more than 220 diamond drill holes and roughly 35,000 meters of drilling. In 1957, a bulk sampling program was undertaken, extracting 454 tonnes of material for metallurgical testing.

Geophysical surveys, including magnetic, electromagnetic, and induced polarization, were also conducted to better define the deposit.

This early work culminated in a historical resource estimate of 5.3 million tonnes grading 0.25% nickel, 0.14% copper, and 0.03% cobalt.

Exploration on the project was eventually shuttered in the 1980’s – the economics of the time just couldn’t justify further development. Nickel and copper prices were low, cobalt and platinum had little strategic value, and exploration tools were limited to what could be seen at surface.

Today, the equation has changed completely.

Modern exploration technology allows geologists to define polymetallic systems that older operators could never fully understand. Government policy has also shifted. Both Canada and the U.S. have made securing supplies of these minerals a national priority, backed by incentives and federal funding.

And because the project is located in Quebec’s storied mining corridor, it benefits from year-round road access, nearby hydroelectric power, and established infrastructure.

As North America’s industrial base expands, the need for copper wiring, stainless steel, and strategic alloys will only accelerate. Positioned in one of the world’s most mining-friendly jurisdictions, on a project with a history of production, Nicobat offers direct leverage to the metals most in demand.

7 Key Advantages That Position Formation Metals (CSE: FOMO, OTC: FOMTF) for Growth

- Gold in the Ground, With Expansion Underway

Nearly 900,000 ounces of historic gold resources have been defined at the N2 Project in Canada’s Abitibi Greenstone Belt, one of the most prolific gold regions on earth. - Exploration with Imminent Catalysts

A 20,000-metre, multi-phase drill program is fully funded and now in motion – with historic holes have hit gold 70–80% of the time. - Strategic Titanium Exposure

Formation’s titanium project lies adjacent to Rio Tinto’s Lac Tio mine, one of the world’s highest-grade titanium deposits. Titanium is designated a U.S. critical mineral, with defense and aerospace spending accelerating demand. - Polymetallic Upside

The Nicobat project provides exposure to nickel, cobalt, copper, and platinum metals critical to defense systems, data centers, and energy infrastructure. Forecasts call for nickel demand to double or even triple by 2030.xxii - Proximity to Majors

Formation’s projects are strategically located near producing mines and advanced projects operated by Rio Tinto, Hecla, Agnico, and Maple Gold – highlighting the potential for large-scale development.xxiii,xxiv - Sustained Policy Tailwinds

North America’s largest infrastructure project, a $175 billion missile defense shield and new Space Command headquarters, will require staggering volumes of critical metals. Formation’s portfolio aligns directly with this demand, from gold in satellites to titanium in fighter jets and alloys in aerospace systems.xxv - Fast Track Path To Development

Formation’s projects are located in Quebec and Ontario, among the world’s safest and most mining-friendly regions. With year-round road access, nearby hydroelectric power, and established infrastructure, exploration and development can move faster and at lower cost.

Formation Metals (CSE: FOMO, OTC: FOMTF) is advancing projects that align with the defining trends of our time: AI, national defense, and domestic manufacturing. With gold in the ground, critical metals exposure, and fully funded exploration programs underway, the company is positioned to benefit from the commodity supercycle shaping the modern economy.

For those looking to dig deeper, the best place to start is the company’s official site, There you’ll find the latest press releases, technical details, and project updates. Or sign up below to be the first to receive exploration results and corporate news directly from Formation Metals.

Start Tracking Formation Metals - Add It To Your Watch List Today!

i https://www.ap.org/news-highlights/spotlights/2025/trump-selects-concept-for-175-billion-golden-dome-missile-defense-system/

ii https://www.lockheedmartin.com/en-us/capabilities/missile-defense/golden-dome-missile-defense.html

iii https://ca.news.yahoo.com/trump-announce-u-space-command-173854608.html

iv https://ca.news.yahoo.com/trump-announce-u-space-command-173854608.html

v https://www.ap.org/news-highlights/spotlights/2025/trump-selects-concept-for-175-billion-golden-dome-missile-defense-system/

vi https://www.nasa.gov/marshall/

vii https://www.gold.org/goldhub/research/gold-investor/gold-investor-july-2018/13231

viii https://www.google.com/finance/beta/quote/GCW00:COMEX

ix https://www.tipranks.com/news/gold-vaults-to-record-high-as-jpmorgan-eyes-4250-price-target-for-2026

x https://www.gold.org/goldhub/research/central-bank-gold-reserves-survey-2025

xi https://www.visualcapitalist.com/sp/canadas-gold-exploration-frontier-the-abitibi-greenstone-belt/

xii https://formationmetalsinc.com/n2-project/

xiii https://www.eurasiantimes.com/key-for-stealth-fighters-f-22-f-35-us-gets-serious-over-titanium/#google_vignette

xiv https://www.precedenceresearch.com/titanium-market

xv https://www.defense.gov/News/News-Stories/Article/article/4227847/senior-officials-outline-presidents-proposed-fy26-defense-budget/

xvi https://www.niocorp.com/trump_designates_all_of_niocorps_minerals_as_critical/

xvii https://formationmetalsinc.com/rio-titanium-project/

xviii https://miningexplained.com/the-lassonde-curve/

xix https://news.un.org/en/story/2025/05/1163111

xx https://nickelinstitute.org/en/nickel-applications/stainless-steel/the-nickel-advantage/

xxi https://source.benchmarkminerals.com/article/battery-nickel-demand-set-to-triple-by-2030

xxii https://source.benchmarkminerals.com/article/battery-nickel-demand-set-to-triple-by-2030

xxiii https://formationmetalsinc.com/rio-titanium-project/

xxiv https://formationmetalsinc.com/n2-project/v

xxv https://www.ap.org/news-highlights/spotlights/2025/trump-selects-concept-for-175-billion-golden-dome-missile-defense-system/

IMPORTANT NOTICE AND DISCLAIMER

This article is a paid advertisement. Think Ink Marketing and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by profiled companies or third parties to organize marketing campaigns, which include the creation and dissemination of these types of communications. In this case, in an effort to enhance public awareness of for Formation Metals Inc. (“FOMTF”) and its securities, FOMTF has provided the Publisher with a budget of approximately $100,000 USD to cover the costs associated with the creation and distribution of this communication. The Publisher may retain any excess sums after expenses as its compensation. This compensation should be viewed as a major conflict with our ability to be unbiased. Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur. This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by FOMTF) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP.

The Publisher does not own any shares of FOMTF and has no information concerning share ownership by others of in FOMTF. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

FORWARD LOOKING STATEMENTS.

This publication contains forward-looking statements, including statements regarding expected continual FOMTFwth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to FOMTF’s industry; (b) market opportunity; (c) FOMTF’s business plans and strategies; (d) services that FOMTF intends to offer; (e) FOMTF’s milestone projections and targets; (f) FOMTF’s expectations regarding receipt of approval for regulatory applications; (g) FOMTF’s intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) FOMTF’s expectations regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute FOMTF’s business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) FOMTF’s ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) FOMTF’s ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) FOMTF’s ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of FOMTF to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) FOMTF operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact FOMTF’s business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing FOMTF’s business operations (e) FOMTF may be unable to implement its FOMTFwth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

INDEMNIFICATION/RELEASE OF LIABILITY.

By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

INTELLECTUAL PROPERTY.

Think Ink Marketing is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Tycona Media Ltd. Articles appearing on this website should be considered paid advertisements. Tycona Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

The Website Host has been paid approximately $500 per month while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling Formation Metals Inc. (“FOMTF”).

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled compannies and has no information concerning share ownership by others of any profiled companies. The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of FOMTF or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about FOMTF Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in FOMTF’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Tomorrow Investor is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding FOMTF’s future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to FOMTF’s industry; (b) market opportunity; (c) FOMTF’s business plans and strategies; (d) services that FOMTF intends to offer; (e) FOMTF’s milestone projections and targets; (f) FOMTF’s expectations regarding receipt of approval for regulatory applications; (g) FOMTF’s intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) FOMTF’s expectations regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute FOMTF’s business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) FOMTF’s ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) FOMTF’s ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) FOMTF’s ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of FOMTF to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) FOMTF’s operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact FOMTF’s business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing FOMTF’s business operations (e) FOMTF may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of FOMTF or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of FOMTF or such entities and are not necessarily indicative of future performance of FOMTF or such entities.

COMPANY SPOTLIGHT