- Commodities

- October 5, 2025

- Editorial Feature

Reviving One Of Canada’s Richest Gold Mines

Gold Terra Resource Corp. (TSX.V:YGT, OTCQB:YGTFF) taps veteran mine-builder Gerald Panneton to unlock a historic producer in Yellowknife.

Distributed on behalf of Gold Terra Resource Corp. Please see the disclaimer below.

“After 40 years as a successful gold explorer and developer, I still love the mining business and I can’t turn away from a golden opportunity. In this case, it is the prolific Campbell Shear in the Yellowknife mining camp, including the former Con Mine.”

— Gerald Panneton, CEO, Gold Terra Resource Corp¹”

When Gerald Panneton sets his sights on a project, the mining industry pays attention.

Known for his precision and execution, Panneton was the founder and former President / CEO of Detour Gold Corporation.

Between 2006 and 2013, he transformed the Detour Lake project from a 1.5-million-ounce resource into over 16 million ounces in reserves, bringing it into production in just over six years².

The foundation he built was later sold to Kirkland Lake Gold for $4.9 billion in January 2020³.

Today, Detour Lake stands as Canada’s largest gold producing operation⁴.

During his tenure at Detour Gold, Panneton raised approximately $2.6 billion in capital and earned the PDAC 2011 Bill Dennis Award for Canadian mineral discoveries and development⁵.

He now brings that same fast-track development mindset to Gold Terra Resource Corp. (TSX.V:YGT, OTCQB:YGTFF).

At the center of his new focus: reviving the high-grade Con Mine in Yellowknife, Northwest Territories.

He describes it as “a simple target with a simple goal.”

Six Million Ounces of Gold And Counting

Originally in operation from 1938 to 2003, the Con Mine produced 6.1 million ounces of gold over its 65-year lifespan⁶.

When it closed gold prices hovered around $300 per ounce⁷, despite the mine’s reputation for high-grade deposits.

Today, the global gold environment has shifted dramatically. As of July 2025, gold has topped to $3,400 per ounce,⁸ more than eleven times its value at the time of Con Mine’s closure.

This price surge is part of a broader structural tailwind for gold – driven by central bank buying, emerging industrial demand, and geopolitical instability.

In this environment, high-grade projects with infrastructure in place are gaining renewed attention, especially those like Con Mine, which were shuttered at a fraction of today’s gold price.

The Golden Spine of Yellowknife

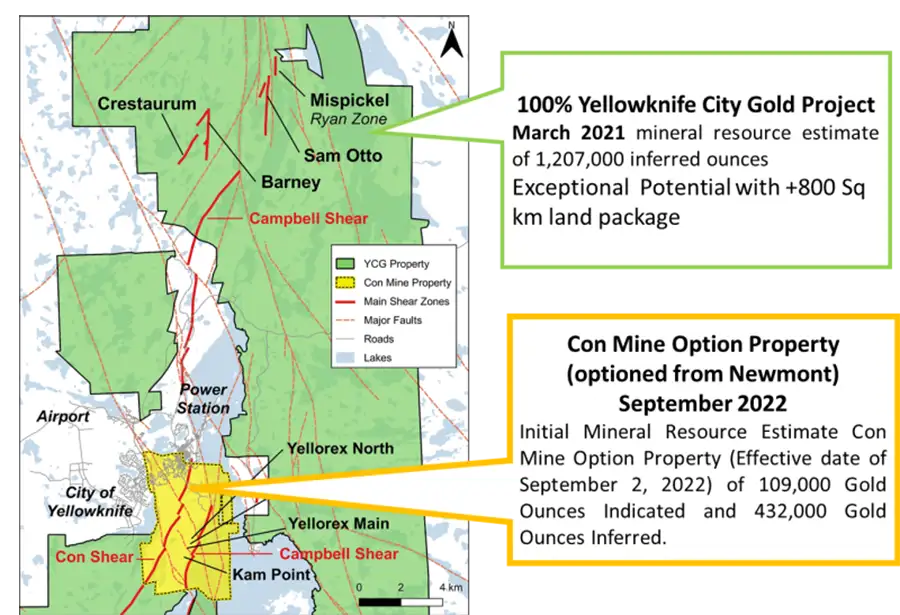

The unique advantage Con Mine holds is its location along the Campbell Shear, one of the most prolific gold-bearing structures in Canada.

Across the broader Yellowknife camp, this shear zone has produced over 14 million ounces of gold historically¹⁰.

The Campbell Shear was discovered within the boundaries of the Con Mine in 1946, brought into production by 1956, and became a very rich zone for gold production after 1963¹¹.

While the Shear extends over 10 kilometers in strike length, up to 175 meters wide, and to depths of 2,000 meters, only a fraction of it was historically mined¹².

Gold Terra’s (TSX.V:YGT, OTCQB:YGTFF) 2025 campaign is designed to change that — targeting previously untouched zones 600–800 meters beneath the Robertson Shaft, using a wedge hole approach from an existing master hole that reached as far as 3,002 meters¹³. These deeper zones were previously inaccessible with older infrastructure or uneconomic at lower gold prices.

The results are expected to be very encouraging.

Early results underscore the potential: One recent intercept returned an astounding 534 grams per tonne (g/t) over 19.3 meters¹⁴ – a level of mineralization that puts the Con Mine in elite company.

Based on more than 21,000 meters of drilling, Gold Terra (TSX.V:YGT, OTCQB:YGTFF) has defined an initial resource of 109,000 ounces indicated at 7.55 g/t and 432,000 ounces inferred at 6.74 g/t¹⁵.

This represents only the upper part of the system—exploration is just beginning to test the deeper potential.

District-Scale Project With Significant Expansion Potential

Beyond Con Mine, Gold Terra controls a 918-square-kilometer land position surrounding Yellowknife²⁰ – one of the largest and most strategically located holdings in the region.

Gold Terra has steadily advanced four key deposits across this region: Sam Otto, Crestaurum, Barney, and Mispickel.

Nearly 70 kilometers of the Campbell Shear runs through this land package, yet only 8 kilometers of that trend has seen historic production²¹.

The remaining ~90% of the property has been largely underexplored.

Recent drilling south of the Con Mine has confirmed the presence of mineralized shear zones bearing quartz veining, sulfides, and visible gold. Many of these areas had never been systematically tested until now.

In March 2021, Gold Terra (TSX.V:YGT, OTCQB:YGTFF) published an updated NI 43-101 resource estimate for the four deposits, confirming a total Inferred resource of 1.2 million ounces, including:

- 8 million tonnes at 1.25 g/t gold(open-pit constrained) for 876,000 ounces, and

- 55 million tonnes at 4.04 g/t gold(underground) for 331,000 ounces. ²³

Together, these deposits represent just a portion of the Campbell Shear trend now under Gold Terra’s control, highlighting the scale of the opportunity and the untapped high-grade potential across the Yellowknife belt.

Existing Infrastructure Reduces Time and Capital Risk

A key advantage of the Con Mine project is its fully built infrastructure. The site includes the 1,950-meter-deep Robertson Shaft, a 10,000-square-foot warehouse, modern roads and utilities, a full dewatering system, and a recently built $10 million water treatment facility¹⁶.

Replicating this infrastructure today would cost between $150 million and $250 million¹⁷.

Underground mining infrastructure accounts for 35% to 60% of total development costs in new builds¹⁸ with average all-in sustaining costs reaching $1,800 per ounce in 2025 as reported by Alamos Gold. ¹⁹ That makes this is a critical advantage.

Gold Terra’s (TSX.V:YGT, OTCQB:YGTFF) inherited infrastructure significantly shortens the development timeline and reduces future capital requirements.

Just as important is the site’s location. Situated next to Yellowknife, the Con Mine has access to a year-round workforce, mature utilities, and transportation infrastructure.

It’s a rare combination. The project holds high-grade potential, built-in infrastructure, and a path to near-term development – without the typical greenfield risks.

5 Reasons To Add Gold Terra Resource Corp. (TSX.V:YGT, OTCQB:YGTFF) to Your Watchlist

- Proven Mine Builder at the Helm

Gerald Panneton took Detour Gold from 1.5 million ounces to over 16 million², raised $2.6 billion⁵, and led the development of what became one of Canada’s largest gold mines, which sold for $4.9 billion³. That same focused approach now drives Gold Terra. - Historic Asset, Modern Gold Economics

Con Mine produced 6.1 million ounces⁶ before closing at $300/oz⁷. With gold now over $3,400/oz⁸, the same proven zones are potentially far more economic, without needing to reinvent the wheel. - Exceptional Drill Results in a Known System

Gold Terra is drilling beneath the historically mined Campbell Shear, returning standout results like 534 g/t over 19.3 meters¹⁴ and defining a high-grade resource of 540,000+ ounces,¹⁵ with deeper targets still to come. - Infrastructure That Fast-Tracks Development

With the Robertson Shaft, full utilities, roads, and a $10M water facility already on-site¹⁶, Gold Terra avoids years of capital-intensive buildout. Replacement cost is estimated at $150–$250 million,¹⁷ a major head start. - District-Scale Opportunity with Defined Path to Ownership

Gold Terra controls 918 km² across Yellowknife, including nearly 70 km of the prolific Campbell Shear²⁰. The company holds an option to acquire 100% of Con Mine from Newmont.²³.

The Yellowknife project hosts a high-grade system, deep infrastructure, and untapped potential, and it’s now under the guidance of one of Canada’s most accomplished mine builders.

From 14 million ounces already extracted to deep zones still unexplored, this proven district offers a rare chance to revive a legacy mine – rapidly, cost-effectively, and under a gold market that has never looked more favorable.

To be the first to receive important news and updates from Gold Terra Resource Corp. (TSX.V:YGT, OTCQB:YGTFF), please enter your email address below.

For more information, visit: www.goldterracorp.com

1https://goldterracorp.com/investors/videos/ 2https://goldterracorp.com/corporate/directors/gerald-panneton/ 3https://resourceworld.com/kirkland-lake-acquiring-detour-gold-for-4-9-billion/ 4Largest Gold Mine in Canada: Detour Lake Producing Over 700,000 Ounces Annually – rcgcorp.cahttps://www.agnicoeagle.com/English/operations/operations/Detour-Lake-Mine/ 5https://pdac.ca/about-pdac/awards/previous-awards-recipients 6https://goldterracorp.com/projects/con-mine-property/overview/ 7https://resourceworld.com/a-conversation-with-geologist-gerald-panneton-executive-chairman-gold-terra-resource-corp/ 8https://goldprice.org 9https://www.marketresearchfuture.com/reports/gold-mining-market-16112 10https://goldterracorp.com/projects/yellowknife-project/campbell-shear-priority-target/ 11 https://www.resource-capital.ch/en/news/view/gold-terra-announces-c15m-strategic-investment-and-option-agreement-with-newmont-to-purchase-100-of-miramar-northern-minings-past-producing-high-grade-gold-con-mine-yellowknife-nwt/ 12https://www.resource-capital.ch/en/news/view/gold-terra-plans-to-drill-prolific-high-grade-campbell-shear-on-its-yellowknife-property/ 13https://resourceworld.com/gold-terra-drilling-campbell-shear-con-mine-northwest-territories/ 14https://theprospectornews.com/critical-investor-gold-terra-resource-looking-to-delineate-multi-million-ounce-deposit-at-yellowknife-city-gold-project-just-raised-c2-5m/ 15https://goldterracorp.com/projects/con-mine-property/overview/ 16https://cabinradio.ca/83984/news/yellowknife/gold-terra-discusses-reviving-con-mines-robertson-shaft/ 17https://www.miningdoc.tech/2025/03/06/how-much-does-it-cost-to-run-a-mining-project/ 18https://mshasafetyservices.com/understanding-the-cost-of-underground-mining/ 19https://www.alamosgold.com/news-and-events/news/news-details/2025/Alamos-Gold-Reports-First-Quarter-2025-Results/ 20 25-07-10_ygt_july_corp_presention_final_for_website.pdf 21https://www.nwtgeoscience.ca/gsforum/re-interpretation-geology-suggests-campbell-shear-extends-north-giant-mine-along-west-shore-walsh 22https://www.streetwisereports.com/article/2021/12/28/new-ceo-for-gold-terra-gerald-panneton.html 23https://goldterracorp.com/projects/yellowknife-project/overview/ 24https://goldterracorp.com/corporate/directors/gerald-panneton/

IMPORTANT NOTICE AND DISCLAIMER

This article is a paid advertisement. Think Ink Marketing and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by profiled companies or third parties to organize marketing campaigns, which include the creation and dissemination of these types of communications. In this case, in an effort to enhance public awareness of for Gold Terra Resource Corp. (“YGT”) and its securities, YGT has provided the Publisher with a budget of approximately $15,000 USD to cover the costs associated with the creation and distribution of this communication. The Publisher may retain any excess sums after expenses as its compensation. This compensation should be viewed as a major conflict with our ability to be unbiased. Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur. This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by YGT) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP.

The Publisher does not own any shares of YGT and has no information concerning share ownership by others of in YGT. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

FORWARD LOOKING STATEMENTS.

This publication contains forward-looking statements, including statements regarding expected continual YGTwth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to YGT’s industry; (b) market opportunity; (c) YGT’s business plans and strategies; (d) services that YGT intends to offer; (e) YGT’s milestone projections and targets; (f) YGT’s expectations regarding receipt of approval for regulatory applications; (g) YGT’s intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) YGT’s expectations regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute YGT’s business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) YGT’s ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) YGT’s ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) YGT’s ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of YGT to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) YGT operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact YGT’s business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing YGT’s business operations (e) YGT may be unable to implement its YGTwth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

INDEMNIFICATION/RELEASE OF LIABILITY.

By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

INTELLECTUAL PROPERTY.

Think Ink Marketing is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Tycona Media Ltd. Articles appearing on this website should be considered paid advertisements. Tycona Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

The Website Host has been paid approximately $500 per month while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling Gold Terra Resource Corp. (“YGT”).

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled compannies and has no information concerning share ownership by others of any profiled companies. The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of YGT or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about YGT Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in YGT’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Tomorrow Investor is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding YGT’s future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to YGT’s industry; (b) market opportunity; (c) YGT’s business plans and strategies; (d) services that YGT intends to offer; (e) YGT’s milestone projections and targets; (f) YGT’s expectations regarding receipt of approval for regulatory applications; (g) YGT’s intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) YGT’s expectations regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute YGT’s business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) YGT’s ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) YGT’s ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) YGT’s ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of YGT to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) YGT’s operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact YGT’s business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing YGT’s business operations (e) YGT may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of YGT or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of YGT or such entities and are not necessarily indicative of future performance of YGT or such entities.

STOCK INFORMATION

RELATED NEWS