- Commodities

- December 30, 2025

- Editorial Feature

The Metal Behind America’s Military, Aerospace, and Drone Dominance

The U.S. imports 91% of its titanium - a critical material in aerospace and drone production. Saga Metals’ Radar Project is one of the few North American discoveries aiming to close that gap.

Over the past few months, it’s become clear: Modern warfare is evolving fast.

Air superiority is no longer defined by fighter jets alone. Drones – agile, autonomous, and rapidly deployed – are now essential to both battlefield operations and national defense strategy.

Behind these machines is one of the most strategically significant materials in the world: titanium.

Lightweight, corrosion-resistant, and nearly as strong as steel, titanium is a cornerstone of the defense sector. It forms 45% of the F-35 Raptor’s airframe and is increasingly indispensable to the next generation of unmanned systems, from surveillance drones to hypersonic missiles.

As U.S. defense spending surpasses $1 trillion, with billions allocated to aerospace and drone initiatives, the next critical mineral spotlight is squarely on titanium.

But it’s not just the military driving demand. Titanium’s strength-to-weight ratio, heat tolerance, and biocompatibility make it essential across a broad range of industries: commercial aerospace, medical implants, chemical processing, and industrial manufacturing.

It’s even a key ingredient in everyday consumer goods like toothpaste and paint.

According to Grand View Research, the global titanium market is projected to reach $52.8 billion by 2029, growing at a 6.2% CAGR.

Yet despite this rising demand, the U.S. remains heavily dependent on foreign sources, primarily China, Russia, and Kazakhstan, for 91% of its titanium supply.

In an era of supply chain instability and geopolitical risk, that reliance has become a concerning vulnerability.

Reshoring critical minerals has become a top priority for policymakers – and Saga Metals (OTCQB: SAGMF, TSX-V: SAGA) is positioning itself to be part of the solution.

The company is advancing what could be one of North America’s most significant new sources of titanium, the Radar Project in Labrador, Canada.

New Discovery In A Proven Critical Mineral Corridor

Just 10 km from the town of Cartwright, the 100%-owned Radar Project spans a massive 24,175 hectares.

The proximity to a coastal town with nearby hydroelectric power, a port, an airstrip, and a skilled local workforce, offers Radar a rare advantage.

Unlike many critical mineral projects in remote terrain, Radar is fully road-accessible year-round, eliminating the need for expensive helicopter transport and dramatically reducing exploration costs.

Early drilling, surface sampling, and geophysical data suggest that Radar could emerge as a globally significant VTM deposit.

The presence of a VTM system is a strong indicator of potential for integrated, multi-metal production – including titanium, vanadium, and iron – all from a single, concentrated ore body.

This can dramatically improve project economics and make downstream processing more efficient and scalable.

The geological model is not theoretical. Saga’s technical team draws direct comparisons to China’s Panzhihua deposit, the largest VTM operation in the world and source of over 40% of global vanadium production.

Like Panzhihua, Radar displays stratiform oxide layering, thick mineralized sequences, and coarse-grained titanomagnetite suitable for the production of high-grade titanium dioxide and vanadium pentoxide.

But those early indicators were just the beginning.

What Saga Metals (OTCQB: SAGMF, TSX-V: SAGA) discovered during the 2025 field season would firmly establish Radar as one of the most exciting VTM exploration stories in North America.

Magnetometer Readings Maxed Out the Machine

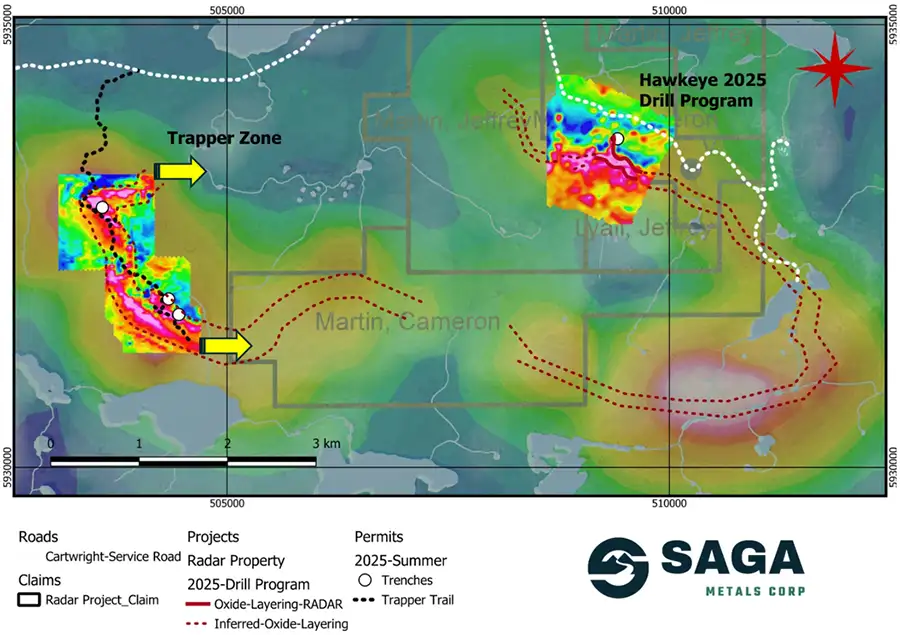

Saga’s 2025 geophysical program put Radar on the map.

In the Trapper zone, a priority target on the property, magnetometer readings exceeded 115,000 nanoteslas, pushing past the upper limit of the equipment’s detection range.

Readings this intense are typically associated with dense, high-grade magnetite-rich systems – exactly what Saga hoped to find.

The results were so strong they forced a full recalibration of Saga’s instruments.

Work to date has outlined a 20+ kilometer trend of titanium-vanadium-bearing rock, with early drilling showing thick oxide zones up to 400 meters, rivalling some of the best titanium systems in the world.

Saga has since kicked off a 2025–2026 drill campaign at the nearby Trapper Zone, targeting a continuous 3.3 km magnetic oxide layering trend. Up to 15,000 meters of drilling across roughly 25-30 holes is planned, with the first 1,500 – 2,500 meters set to be completed in Q4 of this year, focused on a handful of key cross sections in Trapper North and Trapper South.

The goal? To gather the data needed for a maiden mineral resource estimate in the second half of 2026.

The first holes at Trapper North have been especially striking, containing between 35% – 90% oxide content:

- Hole R-0008hit 156 meters of continuous, magnetite-rich oxide rock within a 270+ meter hole.

- Step-out hole R-0009, drilled 100 meters away on the same section, not only confirmed the same unit butextended it by another 165 meters, with even stronger magnetite content.

- Hole R-0010 helped refine the shape and orientation of the mineralized layers, improving Saga’s 3D model of the system.

Put simply, the Radar project is showing continuity, exactly what you want to see when working toward a resource.

Drilling has continued 100 meters to the east of R-0009 and R-0010. Hole R-0011 has reached a depth of 200 meters and is already adding new strike length to the semi-massive to massive oxide zone defined in the first cross section.

Once R-0011 is completed, the drill will move to Trapper South, where Saga will establish a second full cross section. Expected to include 4 holes, the southern program will help map the oxide layers across the broader magnetic anomaly.

And just this year, the company built a 4.2-kilometer access trail, known as the “Trapper Trail”, directly through the Trapper zone and along the oxide layer strike. This has eliminated the need for helicopter support and brought drill costs down to $300–$350 per meter, a major cost advantage.

In the neighboring Hawkeye zone, the company drilled 2,209 meters across seven holes and returned standout results.

That included 57.7 meters grading 5.3% titanium and 0.365% vanadium, with iron content as high as 49%. Another hole intercepted 20.2 meters at titanium at 6.32% and vanadium at 0.435%.

Trenching work further confirmed the scale of the system, revealing more than 500 square meters of surface mineralization with wide layers of vanadiferous titanomagnetite (VTM).

Lab analysis confirmed that the mineralized rock at Radar is consistent, clean, and indicates potentially easy processing, an important advantage in turning rock into salable metal.

Simpler metallurgy means lower costs, faster development, and higher potential margins. It’s one of the reasons Saga believes Radar can advance more efficiently than many comparable titanium-vanadium projects.

A Blueprint for World-Class Titanium Supply

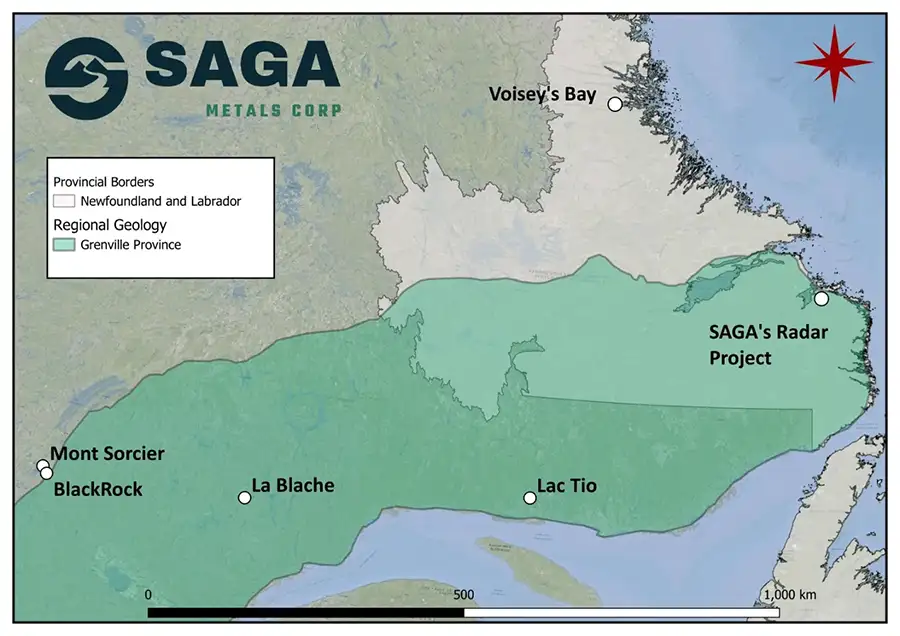

The Grenville Geological Province is already home to some of the world’s largest and longest-producing titanium systems, and recent assay results suggest Radar could soon join that list.

Just to the southwest lies Rio Tinto’s Lac Tio Project. Lac Tio has been a cornerstone of Rio Tinto’s titanium operations for more than 70 years. The site is a world-leading producer of high-grade titanium dioxide feedstock, with annual production of titanium slag exceeding 1 million metric tonnes.

Notably, Saga Metals (OTCQB: SAGMF, TSX-V: SAGA) already has an established partnership with Rio Tinto through its lithium project (more on that below), raising the strategic relevance of Radar’s proximity to Lac Tio.

Further to the southwest sit three more advanced-stage titanium-vanadium projects: Temas Resources’ La Blache Project, Strategic Resources’ BlackRock Project, and Cerrado Gold’s Mont Sorcier Project.

Together, these deposits represent hundreds of millions of tonnes in inferred and indicated resources.

As they progress toward production, they’re helping to catalyze a broader transformation of the Grenville Province into a globally recognized titanium-vanadium production corridor.

Radar’s potential becomes even more compelling when viewed in the context of its neighbors. The project shares key geological characteristics with its peers but benefits from better infrastructure, cleaner mineralogy, and earlier community alignment.

It’s a rare opportunity to advance a discovery-stage asset in a region already preparing to supply the next generation of strategic metals.

Lithium, Uranium, and Strategic Partnerships

While Radar remains the flagship, Saga Metals is not a one-asset story.

The company also controls additional critical mineral assets that position it for long-term relevance as domestic mineral production accelerates.

Legacy Lithium Project

The Legacy Lithium Project covers more than 65,000 hectares in the heart of Quebec’s rapidly expanding James Bay lithium district.

The project is located along strike from major discoveries held by Winsome Resources, Azimut Exploration, and Loyal Lithium – and notably, is subject to a strategic partnership with Rio Tinto.

This partnership enhances Saga’s technical and financial capabilities and highlights institutional confidence in the project’s geological potential.

Legacy Lithium shares the same structural corridor as Rio Tinto’s own exploration efforts in the region, offering a compelling platform for further development.

The significance of this cannot be overstated. With the Radar project situated geologically near Rio Tinto’s Lac Tio titanium operations, the lithium partnership hints at deeper strategic alignment.

Double Mer Uranium Project

The Double Mer Project covers 25,600 hectares and sits close to major uranium discoveries held by Paladin Energy and Atha Energy. Recent exploration suggests Double Mer could host a large-scale uranium system. Saga has mapped an 18-kilometer uranium trend with three key targets. Surface samples returned grades up to 0.428%, along with strong radiometric readings reaching 27,000 cps.

Field teams have confirmed a robust mineralized system with multiple styles of uranium enrichment, and petrographic analysis points to strong geological consistency across the project.

Double Mer is now fully permitted and drill-ready, supported by Saga’s upgraded, year-round 10-person winterized camp, refurbished in 2025.

The 25,600-hectare Double Mer Project is focused on uranium exploration in an area that has seen millions of dollars in historical investment.

The site includes a fully winterized camp, significant historical drill data, and high-priority targets for follow-up work.

With demand for uranium rising in step with AI-driven power consumption and renewed nuclear adoption across the West, Saga’s presence in this space provides additional upside.

8 Reasons to Add Saga Metals (OTCQB: SAGMF, TSX-V: SAGA) To Your Watchlist

- Lithium Partnership with Rio Tinto

Saga’s Legacy Lithium Project is already under partnership with Rio Tinto Exploration Canada (RTEC). As part of the agreement, Rio Tinto Exploration Canada (RTEC) has the option to acquire an initial 51% interest in Saga’s Legacy Lithium Project over four years. Should RTEC earn the initial interest, they have a further option to increase their stake to 75%. RTEC will operate the project during these option periods, with a joint technical committee overseeing exploration. This collaboration provides Saga Metals with resources and expertise while allowing them to focus on other projects. Total financial commitment to earn 75% C$44.4 million. - Magnetometer Readings That Maxed Out Equipment

During the 2025 field season, magnetometer readings exceeded 115,000 nanoteslas in the Trapper zone, surpassing instrument thresholds and confirming the presence of massive titanomagnetite bodies at surface. - Near-Term Catalysts

A 15,000-meter, multi-phase drill program is underway at the Trapper Zone, with Phase 1 (1,500–2,500 meters) already delivering three completed holes and a thick cross section of heavy oxide layering. Additional holes stepping east along strike and a move to Trapper South are planned ahead of a maiden mineral resource estimate targeted for H2 2026, supported by metallurgical test work on core from both Hawkeye and Trapper. - Fully Road-Accessible and Cost-Efficient

Unlike many remote exploration projects, Radar is road-accessible, power-adjacent, and located just 10 km from the town of Cartwright’s deepwater port. Drilling costs are projected at just $300–$350 per meter, one of the lowest in the sector. - Globally Recognized Geological Belt

Radar sits within the Grenville Geological Province, home to world-class titanium deposits like Rio Tinto’s Lac Tio. The same rock types, same structural settings – and still largely underexplored in Labrador. - Panzhihua-Scale Potential

Saga’s Radar Project shares striking geological similarities with China’s Panzhihua, the world’s largest VTM deposit. The company has already drilled thick, high-grade intercepts across just a fraction of its 24-kilometer oxide layering trend. - Optionality in a Nuclear World

Saga’s Double Mer uranium project gives it exposure to the rapidly accelerating nuclear energy narrative, as governments look to power AI-era data infrastructure and decarbonize grids. - Titanium’s Moment Has Arrived

With titanium demand rising across aerospace, drone warfare, and military supply chains—and the U.S. 91% reliant on foreign supply, making Saga’s Radar Project timely and strategic.

The Radar Project, defined by its Panzhihua-like scale, clean mineralogy, and robust infrastructure, has the potential to be one of the most promising VTM discoveries on the continent.

Early-stage drilling has tested less than 3% of the total oxide layering strike length and already yielded grades and intercepts that exceed expectations. The magnetic signatures, mineral continuity, and supportive jurisdiction all reinforce long-term potential.

But perhaps the most important element is diversification. With exposure to titanium, vanadium, iron, lithium, and uranium – and with a demonstrated ability to attract tier-one partners like Rio Tinto – Saga Metals (OTCQB: SAGMF, TSX-V: SAGA) offers leverage to some of the most important industrial shifts of this decade.

Visit the company’s website to learn more or sign up above to receive timely updates on news, milestones, and investor materials as they become available.

IMPORTANT NOTICE AND DISCLAIMER

This article is a paid advertisement. Think Ink Marketing and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by profiled companies or third parties to organize marketing campaigns, which include the creation and dissemination of these types of communications. In this case, in an effort to enhance public awareness of for SAGA Metals Corp. (“SAGA”) and its securities, SAGA has provided the Publisher with a budget of approximately $10,000 USD to cover the costs associated with the creation and distribution of this communication. The Publisher may retain any excess sums after expenses as its compensation. This compensation should be viewed as a major conflict with our ability to be unbiased. Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur. This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by SAGA) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP.

The Publisher does not own any shares of SAGA and has no information concerning share ownership by others of in SAGA. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

FORWARD LOOKING STATEMENTS.

This publication contains forward-looking statements, including statements regarding expected continual SAGAwth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to SAGA’s industry; (b) market opportunity; (c) SAGA’s business plans and strategies; (d) services that SAGA intends to offer; (e) SAGA’s milestone projections and targets; (f) SAGA’s expectations regarding receipt of approval for regulatory applications; (g) SAGA’s intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) SAGA’s expectations regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute SAGA’s business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) SAGA’s ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) SAGA’s ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) SAGA’s ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of SAGA to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) SAGA operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact SAGA’s business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing SAGA’s business operations (e) SAGA may be unable to implement its SAGAwth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

INDEMNIFICATION/RELEASE OF LIABILITY.

By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

INTELLECTUAL PROPERTY.

Think Ink Marketing is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Tycona Media Ltd. Articles appearing on this website should be considered paid advertisements. Tycona Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

The Website Host has been paid approximately $500 per month while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling SAGA Metals Corp. (“SAGA”).

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled compannies and has no information concerning share ownership by others of any profiled companies. The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of SAGA or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about SAGA Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in SAGA’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Tomorrow Investor is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding SAGA’s future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to SAGA’s industry; (b) market opportunity; (c) SAGA’s business plans and strategies; (d) services that SAGA intends to offer; (e) SAGA’s milestone projections and targets; (f) SAGA’s expectations regarding receipt of approval for regulatory applications; (g) SAGA’s intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) SAGA’s expectations regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute SAGA’s business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) SAGA’s ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) SAGA’s ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) SAGA’s ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of SAGA to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) SAGA’s operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact SAGA’s business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing SAGA’s business operations (e) SAGA may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of SAGA or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of SAGA or such entities and are not necessarily indicative of future performance of SAGA or such entities.

STOCK INFORMATION

RELATED NEWS