The $1 trillion renewable energy market is sending copper demand soaring

Discover Why Analysts Are Calling Copper: “The Most Important Metal in the World…”

And how Regency Silver Corp.’s (TSX.V: RSMX, OTCQB: RSMXF) just announced discovery could be the largest in recent Mexican history.

The world is gearing up for an extraordinary leap towards renewable energy. And while lithium, cobalt, and rare earth metals may steal the headlines…

Another resource is set to play an even more vital role: Copper.

Copper is being called the ‘irreplaceable’ raw material for renewable energy. And some of the world’s top analysts see the red metal soaring in the coming months:

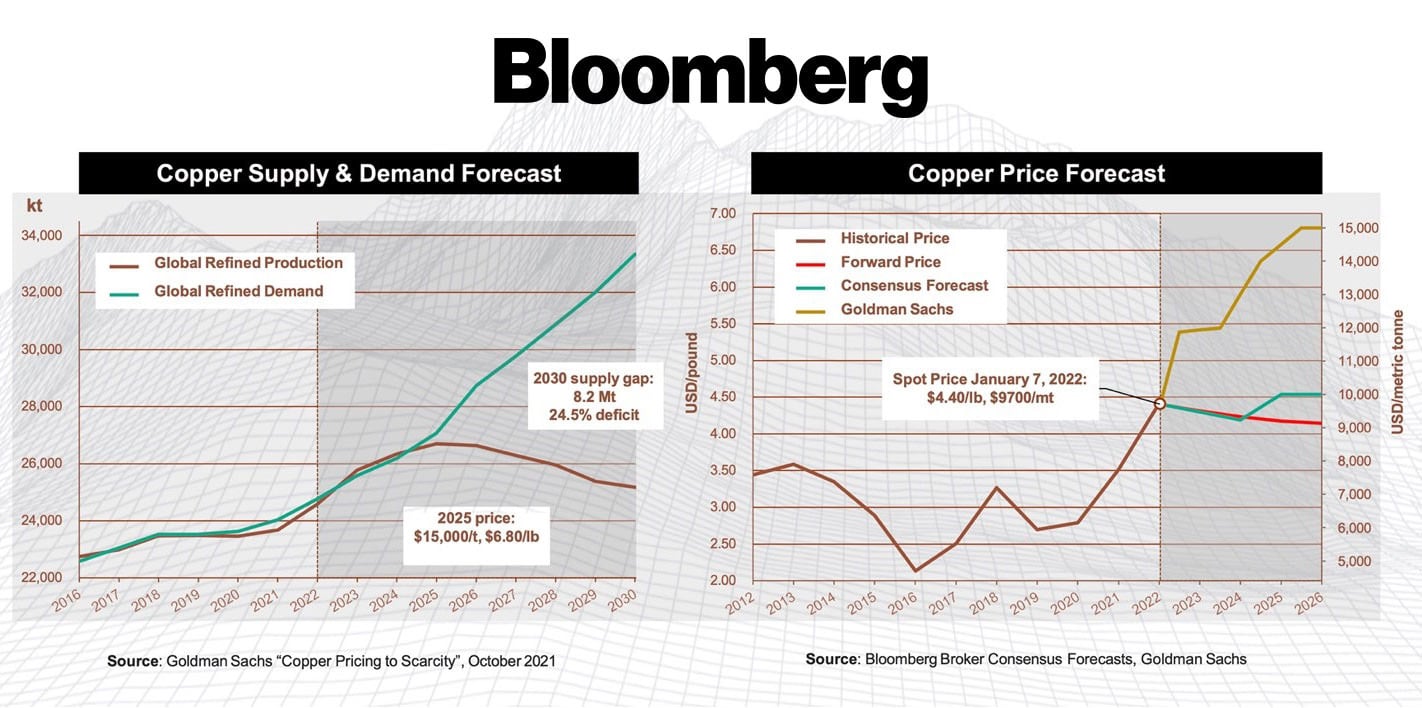

“Copper prices will surge to a record high this year”

“Buy Copper Now Before the Rally to $15,000”

“Copper is the new oil”

Max Layton, the Managing Director of Commodities Research for Citi, believes copper could be on the cusp of a jump that would:

“Make oil’s 2008 bull run look like child’s play” 1

Remember when oil traded for only $10 a barrel? And how prices surged to past $140 in 2008?

A similar move may happen with copper…

Copper is already starting to climb: Prices hit an all-time high last year,2 and according to Bloomberg, it’s the top-performing industrial metal this year.3

Some of the world’s top analysts predict copper prices are about to soar – high above 2022’s record prices…

Billionaire investors like Robert Friedland, George Soros, and Ken Griffin are already positioning themselves in copper stocks.4

Citigroup said it’s an “ideal time”5 for investors to buy –the bank believes the price of copper could double by 2025.6

They’re advising investors to “Buy Copper Now Before the Rally to $15,000”.7

What could that mean for copper? Think about it like this…

- In the 2000s, a 5% supply-demand gap led crude oil to rally 7.5x higher – from $20 a barrel to almost $150.8

- But unlike oil, analysts today aren’t projecting just a 5% copper shortage… they’re projecting a 15% gap this decade.9

If copper follows a similar trajectory to oil, that means prices could jump over 22x their current levels.

The Most Important Metal in the World

Copper is such a critical part of the energy industry that it’s being called “the most important metal in the world”10

It’s almost impossible to replace copper. Here’s why…

- Copper is an excellent conductor of electricity – 5-times better than nickel, almost twice as good as aluminum, and over 10-times better than lead.11 This allows for an efficient transfer of energy, minimizing power losses during both transmission and distribution.

- It has a low resistance rating, which makes it ideal for high-powered applications like power lines and low-voltage wiring.

- And it’s also unmatched in its malleability and pliability – meaning it is easily shaped and stretched without breaking.12

While traditional power sources (like coal, nuclear power, and natural gas) rely heavily on copper… renewable energy can use up to 6 times more!13

Copper will play a key role in the renewable energy revolution…

It’s used extensively in wind turbines – in the generator coils, transformers, and electric cables. According to the International Energy Agency, wind turbines can require 9 tons of copper per MW… that’s more than most African elephants weigh, the largest land animal on earth!14 For comparison, wind turbines require less than half a ton of nickel – roughly the size of a seal...15 and minimal amounts of lithium and cobalt.16

It’s also a crucial element in solar panels – used in the wiring, busbars, and connectors within the panels. Solar power needs over 3 tons of copper per MW – while requiring insignificant amounts of lithium, nickel, or cobalt.17

It’s integral in renewable energy storage – found within the batteries and supercapacitors storing the renewable energy, and within the conductive components enhancing the efficiency and durability of energy storage.

And it’s a necessary component for electric vehicle engines and charging stations. Electric vehicles need over 117 lbs. of copper per MW – more than the amount of nickel and cobalt combined… and almost 6-times the amount of lithium required.18

The tremendous need for the red metal has led to investment research firm DDQINVEST calling it “the irreplaceable raw material for renewable energy”.19

And that’s why companies exploring for this crucial resource – especially those in safe, North American jurisdictions like Regency Silver (TSX:RSMX, OTC:RSMXF) – could be in a prime position to capitalize on the new energy economy.

From Startups To Hundred Million Market Caps

Investors who follow the name Bruce Bragagnolo know what to expect when it comes to his track record with mining ventures

Regency Silver’s founder and Executive Chairman, Mr. Bragagnolo is already famous for three legendary Mexican mines he grew from startups.

- In his first major deal, Mr. Bragagnolo launched Silvermex Resources, an initial $7 million market cap. Then he guided it to a peak market capitalization of more than $170 million. He sold Silvermex to First Majestic Silver at a 33% premium on its final share price and cash.20

The deal put First Majestic on track to become a $3+ billion producer. Today it’s listed on the New York Stock Exchange. - Next, Mr. Bragagnolo founded Timmins Gold Corp. guiding it from a junior exploration company to a 100,000+ ounce-a-year-gold producer that achieved a peak market capitalization of more than $450 million.21

- Finally, Mr. Bragagnolo was a director of Continuum Resources when it acquired the San Jose Mine in Oaxaca, Mexico. Continuum merged with Fortuna Silver. The San Jose Mine is now its flagship asset, producing 5.76 million ounces of silver and 34,000 ounces of gold last year.

But none of these prior projects come close to Mr. Bragagnolo’s newest venture with Regency Silver (TSX:RSMX, OTC:RSMXF). In 40+ years of working in the mining sector, he’s claimed he has never seen results like this…

Legendary Explorer Makes A Substantial New Discovery

In a world in need of new sources of copper, you can bet the mining industry has its eye on what Bruce Bragagnolo is doing in Mexico

Regency Silver has a significant land package in Mexico’s prolific Sierra Madre, that’s host to what appears to be a massive porphyry system, just a few hundred meters from a historical 400-year-old silver mine.

Newly released drill results from the Dios Padre Project have already confirmed the presence of high-grade copper, gold, and silver. Dios Padre is in a good address since it is right in the middle of the prolific Copper Porphyry Belt that starts in Arizona and extends well into Mexico.

Located about 420 meters below the surface, Regency Silver has identified a large mineralized zone that appears to stretch one hundred and eighty meters (590m feet) across and 150 meters (490 feet) high. That’s the size of a 45-story building with a high grade core that is 18 stories thick.

That includes 0.88% copper, 54.65m of 5.34 g/t gold, 35.8m of 6.84 g/t gold, 29.4m of 6.32 g/t gold, and 21.82 g/t silver.

That translates to 10X to 15X more gold per ton than the company’s closest competitors, making it one of the richest discoveries in recent Mexican history.

Bruce Bragagnolo declared:

“The gold breccia is a large, high grade gold zone. Consistently drilling into a mineralized zone as thick as an 18-story building builds our confidence that we can extend the high-grade core along strike with strong potential for continued high grade zones up-dip 400m toward the historic silver mine.”

Comprising a total of 10 holes, the 2023 drill program spanned over a length of 6,000 meters. Eight out of the nine holes targeting the lower Dios Padre breccia zone confirmed the presence of significant mineralization.

And the company has only scratched the surface. The mineralized zone has the potential to extend much further, potentially in any or all directions. The potential of the project is highlighted by the fact that the copper zone is a separate geological system which typically is found in clusters and expands at depth.

Further exploration is anticipated, as the company continues to gauge the size and grade of this prolific system.

That makes this the perfect timing to dig into research on Regency Silver Corp. (TSX:RSMX, OTC:RSMXF) – before the next set of results hit the newswire.

The timing couldn’t be better, as copper supply dwindles in the face of escalating demand.

Copper’s Chronic Supply Gap Widens

Just weeks ago, in early October, the world’s largest copper producers warned that there is a serious shortage of mines under development22

It appears that some of the larger, more established mines are nearly tapped out of high-grade copper.

And it’s been years since a massive new high-grade copper deposit has been found.

In fact, the amount of new copper found during the past 15 years – 143 metric tons – is nearly as much copper as was discovered in 1991 alone.23

As you’d assume, the mismatch between discoveries and the forecast for demand looks set to create a supply crisis.

That could slam the brakes on the emerging clean-energy shift.24

The growing deficit is so significant that copper miners will fail to keep pace with demand.

Multinational goliath BHP Group says that copper investment may need as much as $250 billion in the next six years alone to satisfy demand.25

Analysts at the well-respected S&P Global are forecasting the demand for copper to climb to 50 million metric tons a year – that’s double copper miners’ current output.26

That disturbing fact also led S&P Global analysts to predict a “chronic gap” between copper supply and demand.

With its new copper deposit discovery, and early indications that it could be a whopper, Regency Silver (TSX:RSMX, OTC:RSMXF) could find itself in the heart of a copper bidding war.

The Irreplaceable Raw Material for the Renewable Energy Revolution27

An energy transition is on the horizon… one that will dramatically change the energy landscape of our nation.

In 2022, 79% of all U.S. energy consumption came from fossil fuels – almost 36% came from petroleum, over 33% was from natural gas, and coal accounted for almost 10%.

Renewables – including wind and solar – only provided 13% of the U.S.’s energy.28

But all of that is about to dramatically change – in fact, it could be about to completely flip…

The White House is pushing for 80% clean energy by 2030.29

This means, a complete swap of energy sources could be here in just 7 years.

The White House’s plans are part of the larger Paris Agreement, where the United States – along with 192 other nations plus the European Union – formed a legally binding international treaty to substantially reduce greenhouse gas emissions.30

Under the Agreement, all countries are to reduce their emissions and reach net zero carbon emissions by 2050.

According to the United Nations, the energy sector is the highest offender – emitting around three-quarters of all greenhouse gasses.

“Replacing coal, gas, and oil power with renewable energy sources – like wind and solar – could dramatically reduce carbon emissions.” 31

And as the world transitions from these conventional power sources to reduce greenhouse gas emissions and meet Net Zero by 2050 – it’s not surprising that the demand for copper is projected to steadily increase over the next few decades.

S&P Global predicts demand for copper will double by 2035.32 By 2050, demand will steadily grow to 53 million metric tons.

To put that figure in perspective, that’s more copper than the entire world consumed between 1900 and 2021.33

Supply may not be able to keep pace. In fact, analysts are predicting a major supply-demand imbalance…

By 2035, S&P Global estimates the annual supply gap could hit almost 10 million metric tons – which is around 20% of the amount required to achieve net zero in 2050.34

- According to S&P Global, a chronic copper shortfall could begin as early as next year.35

- While CNBC reports a shortage could even start this year!36

An Expanding Global Middle Class Is Driving Demand

Copper is also the key to the economic rise of India and other developing nations

As an example, the living standards of the average American requires 450 pounds to 500 pound of copper per person… between, smartphones, home or apartment wiring, and appliances.

While globally, in developing countries, the average individual’s need is about 130 pounds.

That’s according to Anglo American, one of the world’s largest miners.37

But here’s a startling fact about developing countries.

It’s anticipated that globally more than 113 million people will join the middle class, or what’s considered the “consumer” class in 2024. And that pace is expected to continue – with each year adding another 100 million to their middle class.38

That’s what led analysts at The Visual Capitalist to forecast that today’s middle class of 4 billion consumers will become 5 billion in the next seven years.39

And 81% of that expansion will be in Asia, including 91 million new Asian middle-class consumers next year.

If you’ve always wondered how experts figured out that EV sales will top 350 million vehicles by 2030… the skyrocketing global middle class is the key metric.

As the demand for copper has gone up over the past couple years, so has its price and with demand expected to surge in the coming years, one expert thinks…

The Price of Copper Could Go Up “10-Fold”

In an interview with Bloomberg, Robert Friedland, chairman and co-founder of Ivanhoe Mines Ltd., a company with a $16 billion market capitalization, warned of a copper shortfall, “We are heading towards a train wreck.”

He predicts the supply-demand imbalance could cause the price of copper to go up 10-fold.40

During the FT Commodity Global Summit in Switzerland, Kostas Bintas, co-head of metals and minerals at Trafigura, speaking of copper said,

“What’s the price of something the whole world needs but we don’t have any of?” 41

The bottom line: there is simply no way to stop the projected shortage in copper and meet net zero by 2050 without taking steps to increase supply.42

And while companies can try to increase the output of existing mines, the only viable answer to solving the supply crunch is…

The world needs new mines.

And that’s where high-potential exploration projects like Regency Silver’s Dios Padre project could become highly sought after.

The Top 5 Reasons To Consider Adding Regency Silver (TSX:RSMX, OTC:RSMXF) To Your Watchlist

- Renewable energy’s irreplaceable raw material. Copper is a critical part of the energy transition – arguably more than lithium, more than cobalt, and more than nickel. Renewable energy can use up to 6 times more copper than traditional power sources, like coal and natural gas. As the world transitions from conventional power sources, the demand for copper is projected to skyrocket.

- Experts believe copper prices could soar. As the demand is projected to rise for copper, so is its price. But supply may not be able to keep pace with demand, and a projected copper shortage could send the prices much higher. A copper shortage could begin as early as this year, and Citigroup predicts the price of copper could double by 2025. Other analysts are comparing copper’s projected bull run to oil’s run in the 2000s.

- The world will need new mines to meet Net Zero. According to S&P Global, increasing the output of existing mines alone won’t be enough to solve the projected supply crunch. The world will need new mines to produce enough copper and achieve Net Zero by 2050. Companies exploring for this crucial resource, especially those in safe western jurisdictions like Regency Silver – could be in a prime position to capitalize on the new energy economy.

- One of the largest discoveries in modern Mexican history. Regency Silver has already identified large zones of high-grade mineralization – a porphyry system the size of a skyscraper – made up of gold, silver, and copper. And exploration has just scratched the surface, the zones appear to expand in all directions.

- A mining legend at the helm. Mr. Bragagnolo has a long history of transforming mining juniors into world class companies. He founded Timmins Gold as an exploration startup and grew it to mining more than 100,000 ounces a year. Its market cap soared from $7 million to nearly half a billion dollars. He was also the founder of SilverMex Resources, which sold for a 33% premium over its final closing price.43

Learn more about Regency Silver (TSX:RSMX, OTC:RSMXF) on their website, and as always do your own due diligence.

Get A Free Investor Package

1.https://www.usfunds.com/resource/citigroup-says-to-buy-copper-now-before-the-rally-to-15000/ 2.https://tradingeconomics.com/commodity/copper#:~:text=Historically%2C%20Copper%20reached%20an%20all,updated%20on%20July%20of%202023. 3.https://www.ft.com/content/c3da84fd-efe2-4487-accb-511a8104ee3e 4.https://markets.businessinsider.com/news/stocks/billionaire-george-soros-loads-up-on-these-2-strong-buy-stocks-%E2%81%A0%E2%80%94-here-s-why-you-might-want-to-follow-in-his-footsteps-1032325030 5.https://www.insidermonkey.com/blog/10-best-copper-stocks-to-buy-for-2023-1132702/ 6.https://invezz.com/news/2023/07/06/copper-prices-can-surge-ten-times-billionaire-investor-says/ 7.https://www.usfunds.com/resource/citigroup-says-to-buy-copper-now-before-the-rally-to-15000/ 8.https://www.cnbc.com/2023/06/05/copper-stocks-analysts-say-buy-these-miners-and-shares-as-prices-soar.html 9.https://www.usfunds.com/resource/citigroup-says-to-buy-copper-now-before-the-rally-to-15000/ 10.https://www.ft.com/content/c3da84fd-efe2-4487-accb-511a8104ee3e 11.https://www.ft.com/content/c3da84fd-efe2-4487-accb-511a8104ee3e 12.https://moneyweek.com/investments/commodities/industrial-metals/605046/how-to-invest-in-copper-the-most-important-metal-in-the-world 13.https://www.bluesea.com/resources/108/Electrical_Conductivity_of_Materials 14.https://ddqinvest.com/copper-the-irreplaceable-raw-material-for-renewable-energy/ 15.https://copperalliance.org/policy-focus/climate-environment/renewable-energy/ 16.https://seaworld.org/animals/all-about/elephants/characteristics/#:~:text=Size,6%2C000%20and%208%2C000%20lb.). 17.https://thewebsiteofeverything.com/animals/mammals/Carnivora/Phocidae/Cystophora/Cystophora-cristata.html 18.8,000 kgs of copper required in offshore wind, 403.5 kgs of nickel needed in onshore wind https://www.iea.org/data-and-statistics/charts/minerals-used-in-clean-energy-technologies-compared-to-other-power-generation-sources 19.2,822.1 kg of copper https://www.iea.org/data-and-statistics/charts/minerals-used-in-clean-energy-technologies-compared-to-other-power-generation-sources 20.53.2 kg of copper, 8.9 kg of lithium, 39.9 kg of nickel, 13.3 kg of cobalt https://www.iea.org/data-and-statistics/charts/minerals-used-in-electric-cars-compared-to-conventional-cars 21.https://ddqinvest.com/copper-the-irreplaceable-raw-material-for-renewable-energy/ 22.https://www.reuters.com/article/firstmajestic-silvermex/update-1-first-majestic-to-buy-miner-silvermex-for-c175-mln-idUSL2E8F362M20120403 23.https://asiabasemetals.com/corporate/board-of-directors/bruce-bragagnolo/ 24.https://www.ft.com/content/b3ad2631-f8b9-41df-8e2e-b4493738ded8 25.https://www.usgs.gov/faqs/how-much-copper-has-been-found-world 26.https://www.theassay.com/articles/investor-insight/investment-perspectives-supply-and-demand-for-the-metals-needed-for-the-energy-transition/ 27.https://www.theassay.com/articles/investor-insight/investment-perspectives-supply-and-demand-for-the-metals-needed-for-the-energy-transition/ 28.https://www.bloomberg.com/news/articles/2023-10-20/china-strengthens-export-controls-on-some-graphite-items?sref=VcSM8PCz 29.https://ddqinvest.com/copper-the-irreplaceable-raw-material-for-renewable-energy/ 30.https://www.eia.gov/todayinenergy/detail.php?id=56980#:~:text=Fossil%20fuels%E2%80%94petroleum%2C%20natural%20gas,high%2013.2%20quads%20in%202022. 31.https://www.cnbc.com/2021/04/26/white-house-pushing-for-80percent-clean-us-power-grid-by-2030.html 32.https://www.un.org/en/climatechange/paris-agreement 33.https://www.un.org/en/climatechange/net-zero-coalition 34.https://www.spglobal.com/marketintelligence/en/mi/research-analysis/growing-appetite-copper-threatens-energy-transition-climate.html 35.https://www.cnbc.com/2022/07/14/copper-is-key-to-electric-vehicles-wind-and-solar-power-were-short-supply.html 36.https://www.spglobal.com/marketintelligence/en/mi/research-analysis/growing-appetite-copper-threatens-energy-transition-climate.html 37.https://www.spglobal.com/marketintelligence/en/mi/research-analysis/growing-appetite-copper-threatens-energy-transition-climate.html 38.https://www.cnbc.com/2023/02/07/there-isnt-enough-copper-in-the-world-shortage-could-last-until-2030.html 39.https://www.ft.com/content/b3ad2631-f8b9-41df-8e2e-b4493738ded8 40.https://www.visualcapitalist.com/113-million-people-middle-class-2024/ 41.https://www.visualcapitalist.com/113-million-people-middle-class-2024/ 42.https://financialpost.com/commodities/mining/billionaire-robert-friedland-copper-train-wreck 43.https://www.ft.com/content/c3da84fd-efe2-4487-accb-511a8104ee3e 44.https://www.spglobal.com/marketintelligence/en/mi/research-analysis/growing-appetite-copper-threatens-energy-transition-climate.html 45.https://www.reuters.com/article/firstmajestic-silvermex/update-1-first-majestic-to-buy-miner-silvermex-for-c175-mln-idUSL2E8F362M20120403

IMPORTANT NOTICE AND DISCLAIMER

This article is a paid advertisement. Think Ink Marketing and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by profiled companies or third parties to organize marketing campaigns, which include the creation and dissemination of these types of communications. In this case, in an effort to enhance public awareness of Regency Silver Corp. (“RSMX”) and its securities, RSMX has provided the Publisher with a budget of approximately $200,000.00 USD to cover the costs associated with the creation and distribution of this communication. The Publisher may retain any excess sums after expenses as its compensation. This compensation should be viewed as a major conflict with our ability to be unbiased. Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur. This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by RSMX) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP.

The Publisher does not own any shares of RSMX and has no information concerning share ownership by others of in RSMX. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

FORWARD LOOKING STATEMENTS.

This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to RSMX’s industry; (b) market opportunity; (c) RSMX’s business plans and strategies; (d) services that RSMX intends to offer; (e) RSMX’s milestone projections and targets; (f) RSMX’s expectations regarding receipt of approval for regulatory applications; (g) RSMX’s intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) RSMX’s expectations regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute RSMX’s business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) RSMX’s ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) RSMX’s ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) RSMX’s ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of RSMX to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) RSMX operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact RSMX’s business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing RSMX’s business operations (e) RSMX may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

INDEMNIFICATION/RELEASE OF LIABILITY.

By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

INTELLECTUAL PROPERTY.

Think Ink Marketing is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling Regency Silver Corp. (“RSMX”).

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled compannies and has no information concerning share ownership by others of any profiled companies. The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of RSMX or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about RSMX Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in RSMX’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding RSMX’s future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to RSMX’s industry; (b) market opportunity; (c) RSMX’s business plans and strategies; (d) services that RSMX intends to offer; (e) RSMX’s milestone projections and targets; (f) RSMX’s expectations regarding receipt of approval for regulatory applications; (g) RSMX’s intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) RSMX’s expectations regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute RSMX’s business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) RSMX’s ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) RSMX’s ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) RSMX’s ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of RSMX to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) RSMX’s operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact RSMX’s business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing RSMX’s business operations (e) RSMX may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of RSMX or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of RSMX or such entities and are not necessarily indicative of future performance of RSMX or such entities.

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Market Tactic Media Ltd. Articles appearing on this website should be considered paid advertisements. Market Tactic Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

The Website Host has been paid approximately $500 per week while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling Regency Silver Corp. (“RSMX”).

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled compannies and has no information concerning share ownership by others of any profiled companies. The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of RSMX or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about RSMX Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in RSMX’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Market Tactic is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding RSMX’s future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to RSMX’s industry; (b) market opportunity; (c) RSMX’s business plans and strategies; (d) services that RSMX intends to offer; (e) RSMX’s milestone projections and targets; (f) RSMX’s expectations regarding receipt of approval for regulatory applications; (g) RSMX’s intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) RSMX’s expectations regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute RSMX’s business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) RSMX’s ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) RSMX’s ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) RSMX’s ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of RSMX to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) RSMX’s operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact RSMX’s business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing RSMX’s business operations (e) RSMX may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of RSMX or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of RSMX or such entities and are not necessarily indicative of future performance of RSMX or such entities.