- Energy

- June 5, 2025

- Editorial Feature

The Race for Domestic REE Supply Has Begun

$900 Million Bet on U.S. Rare Earths Sends Clear Signal

The White House and Apple just backed MP Materials with a near-billion-dollar lifeline. What it means for America’s rare earth supply chain.

Last century, wars were fought over oil.

This century, the stakes have shifted – toward something even scarcer, and arguably more strategic: rare earth elements.

These obscure metals are now essential to almost every modern technology.

They’re in our smartphones. Our electric vehicles. And our most advanced military systems -including the F-35 fighter jet.i

And now, as trade tensions between the U.S. and China hit new highs, rare earths have become a front-line issue for national security and economic policy. That’s why it’s no surprise the White House is stepping in to take control of domestic production.

In July 2025, the Department of Defense announced a $400 million cash infusion to MP Materials, the lone rare earth producer operating on U.S. soil.

Apple quickly followed suit with an investment of its own – $500 million to ensure a stable supply of rare earth magnets for its devices.

The goal? To dramatically expand domestic refining capacity and break America’s dependence on Chinese-controlled supply chains.

The urgency is justified. China has already shown its willingness to weaponize its control of mineral supply chains. This dominance didn’t happen by accident. It’s the result of a deliberate, decades-long strategy to control every step of the critical minerals value chain.

At the mining stage, state-backed firms secured foreign deposits using equity stakes, long-term offtakes, and diplomatic leverage — especially in Africa, Southeast Asia, and South America.

At the processing stage, they flooded capital into refining capacity — often bypassing environmental safeguards to outcompete rivals.

And in manufacturing, China has secured its spot as the world’s dominant producer of batteries, magnets, and solar panels.ii

Today, that playbook has left America dangerously exposed.

The message from Washington is clear. If the U.S. wants to compete in the age of AI, electrification, and advanced defense – it all comes back to bolstering supply chains.

That’s where U.S. Critical Metals (CSE: USCM, OTC: USCMF) comes in. This explorer operates entirely on U.S. soil, making it one of a very few exploration companies positioned to help America break the bottleneck.

A Track Record of Creating Big Wins

At the Sheep Creek Project in Montana, US Critical Metals has an interest in what may be one of the most significant rare earth find in modern U.S. history.

Early surface samples are returning grades as high as 201,216 ppm — or 20.1% total rare earth content.iii

That’s nearly unheard of. The deposit is also rich in light rare earth elements — the most valuable and in-demand subgroup.

And as of yet, only a small portion of the property has been explored.

For many early-stage explorers, a find like this would be a once-in-a-lifetime opportunity. But for US Critical Metals’ leadership, it’s beginning to look like business as usual.

In fact, one of the company’s founders also supported the formation of Hercules Metals, which soared from just 4 cents to $1.62 CAD in a matter of months following a high-grade copper discovery.iv It became the single best-performing stock on the Toronto Venture Exchange in 2023.v

Now, they’re aiming to do it again.

And yet, despite the early indicators and experienced team, US Critical Metals is still flying under the radar.

With strong early indicators, experienced leadership, and growing national attention on domestic critical mineral supply, US Critical Metals (CSE: USCM, OTC: USCMF) is a story worth watching closely.

And that starts with Sheep Creek.

Once-Overlooked Asset, Rediscovered for a New Industrial Era

Tucked into Montana’s Bitterroot Range, the Sheep Creek Project is shaping up to be one of the most promising rare earth prospects in the United States.

Decades ago, when this site was last mined in the 1950s, rare earth elements (REEs) had little commercial value. The site’s infrastructure was built out, and then sealed in the 1960s — leaving an undisturbed system beneath the surface.vi

US Critical Metals (CSE: USCM, OTC: USCMF) has a direct interest in exploring this long-forgotten asset — and early signs point to strong potential for discovery.

Initial sampling has revealed REE grades as high as 21.1% total rare earth content — a substantial figure by global standards. The mineralization is especially rich in ‘light’ rare earth elements, which typically command premium pricing due to their greater industrial demand.vii

The project spans over 4,500 acres and contains more than 50 mapped carbonatite dikes — geological formations known for hosting rare earths. These dikes form when mineral-rich magma cuts through surrounding rock, cooling into concentrated seams of mineralization. Some of Sheep Creek’s dikes stretch more than 300 meters in length, with yet unknown depth.

Early samples show widespread REE mineralization across the dike system, along with elevated concentrations of other strategic materials — including gallium, a metal critical to semiconductors, 5G networks, and military radar systems.

Gallium is almost entirely controlled by China, which accounts for 98% of global supply.viii And with the only U.S. producer recently shuttered, the domestic market now has a potentially viable new source — Sheep Creek — with surface samples showing grades up to 300 ppm.

Add to that another crucial factor: low thorium content.

Thorium is a radioactive element often associated with rare earth deposits. High levels can trigger costly permitting requirements and environmental concerns. But at Sheep Creek, thorium concentrations have come in under 200 ppm — well below regulatory thresholds.ix

This advantage could substantially simplify future development.

It’s also important to note, this isn’t a project starting from scratch. Thanks to past mining activity, the site contains numerous horizontal mine shafts running through the property —allowing for easy underground access for additional sampling.

All told, Sheep Creek combines many of the elements one looks for in an early-stage resource project:

- Strong surface results

- Favorable geology

- And exposure to critical materials with limited domestic supply chains

For context, MP Materials is currently the only company producing rare earth elements in the U.S.x Its market capitalization today exceeds $3 billion.xi

While no two projects or companies are directly comparable, that highlights the crucial nature of domestic REE production.

And while Sheep Creek is an exciting opportunity, it’s far from the only asset in US Critical Metals’ (CSE: USCM, OTC: USCMF) portfolio.

The company also holds a majority stake in Long Canyon — a high-potential uranium and vanadium project in Idaho that could prove vital as AI fuels a new nuclear renaissance.

Amazon, Google and Meta Push To Triple Nuclear Power

Big Tech is betting on nuclear — and markets are already responding.

Amazon, Google, and Meta have officially signed a global pledge to triple nuclear energy capacity by 2050xii — a clear signal that the AI boom is forcing even the biggest tech players to rethink how the grid gets powered.

Meta, for instance, just unveiled plans for an $800 million AI data center in Indiana.xiii

Its chosen energy partner? Constellation Energy — a major U.S. nuclear utility whose stock surged to record highs on the news.xiv

And Constellation isn’t the only name riding this momentum.

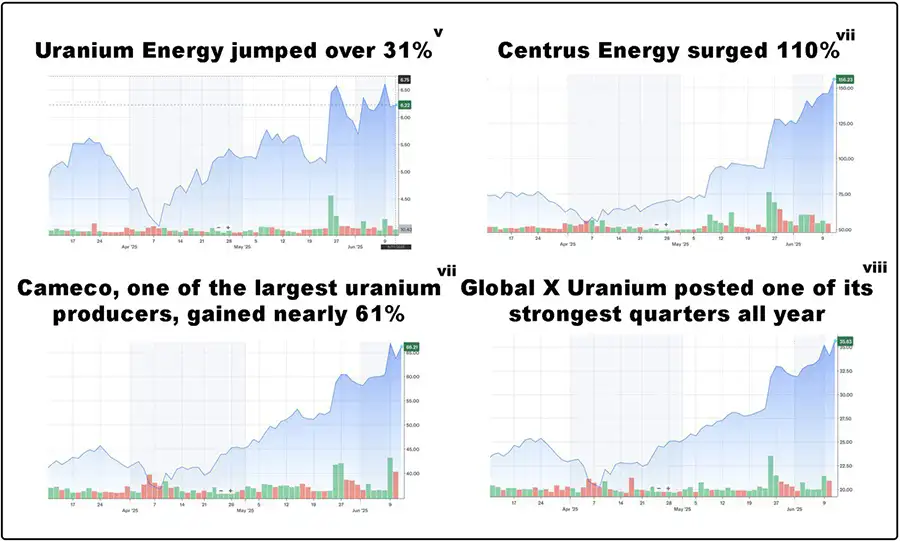

When reports surfaced in May that the Trump administration would issue sweeping executive orders to fast-track new reactors and shore up uranium supply chainsxv, the entire uranium sector lit up.

In the four months that have followed:

- Uranium Energy Corpxvi has jumped over 15%xvii

- Centrus Energy has surged 161%xviii

- Energy Fuels has soared 207%xix

- ETFs like Global X Uranium (URA)xx and HURA posted some of their strongest gains in yearsxxi

Even early-stage players got a boost: Sam Altman–backed Okloxxii, Nano Nuclear Energyxxiii, and NuScale Powerxxiv all notched double-digit gains as investors looked for ways to play the nuclear resurgence.

Meta isn’t alone in its plans either. Microsoft is building a $1 billion nuclear plant in Wyoming.xxviii And it’s backing Oklo, a next-gen nuclear startup designing modular reactors tailor-made for data centers. Oklo’s CEO says customer demand has surged 1,000x in just a few years.

Behind all this is a massive shift in how the U.S. thinks about power. Thanks to AI, data centers, and other power-hungry technologies, U.S. electricity demand is growing again — for the first time in 20 years.

AI needs reliable baseload power, and nuclear is one of the only technologies that can deliver.

Watch: Why AI is Powering A New Nuclear Boom

Trump’s May executive orders — now dubbed by some as “America’s Nuclear Renaissance” — aim to go even farther than big tech’s pledge, with plans to quadruple U.S. nuclear capacity by 2050. The plan includes:

- Fast-tracked approvals for advanced modular reactors

- New tax incentives for uranium production

- A requirement for federal agencies to prioritize nuclear energy procurement

- And the potential rollout of microreactors by the end of the decadexxvi

And it’s not just conventional power generation getting the spotlight. A new class of compact energy tech is emerging: nuclear batteries.

These miniature energy sources use radiocarbon — a byproduct of nuclear energy — that emits only low-energy beta particles. Harmless to humans and easily shielded, their radioactive decay can produce electricity for years without recharging.xxvii

These miniature energy sources use radiocarbon — a byproduct of nuclear energy — that emits only low-energy beta particles. Harmless to humans and easily shielded, their radioactive decay can produce electricity for years without recharging.xxvii

That could soon transform entire industries:

- Phones that never need charging

- Pacemakers that last a lifetime

- Military sensors and space equipment powered continuously for decades

In much the same way solar panels harvest sunlight, nuclear batteries harvest decay energy — compact, efficient, and long-lasting.

There’s just one problem.

Roughly 20% of American power comes from nuclear plants.xxviii Yet nearly all uranium is imported — mostly from Russia-aligned Kazakhstan, and other post-Soviet states like Uzbekistan and Russia itself. Only Canada and Australia are strong U.S. allies, leaving the U.S. supply chain dangerously exposed.xxix

That’s where Long Canyon comes in. As the AI race accelerates, domestic sources like Long Canyon could become critical to securing the fuel that keeps the grid and the economy running.

Unlocking America’s Next Uranium Hotspot

Sweden’s Viken Project, image courtesy of Crux Investor xxxiv

Located in mining-friendly Idaho, Long Canyon is quickly emerging as one of the most compelling uranium projects in the western United States.

The region has long been known for its rich geology, but new exploration is revealing a far broader and more valuable story.

Recent fieldwork by US Critical Metals’ (CSE: USCM, OTC: USCMF) has uncovered two distinct mineral systems.

The first is a uranium–vanadium corridor hosted in black shales. Sampling returned grades as high as 598 ppm uranium and more than 9,000 ppm vanadium, alongside notable levels of nickel and molybdenum.

Mapping and geochemistry suggest this system extends for roughly 4.3 kilometers —the equivalent of more than 40 football fields laid end-to-end.

The only comparable project in the western world may be Sweden’s Viken deposit, held by District Metals Corp. But early results suggest Long Canyon offers significantly higher uranium grades compared to Viken’s ~175 ppm, and benefits from a U.S. jurisdiction where federal policy is now prioritizing domestic uranium supply.xxx

Exploration also uncovered a new silver-lead-zinc system in surrounding carbonates. Rock samples from this zone returned up to 354 grams per tonne silver, nearly 4% lead, and close to 1% zinc, evidence of a second mineralized corridor with its own strategic potential.

Together, these results confirm Long Canyon as a true polymetallic project, with uranium and vanadium tied to America’s nuclear buildout, and silver, lead, and zinc adding further industrial relevance as the U.S. reshapes its supply chains.

As the U.S. accelerates both its nuclear and industrial buildout, Long Canyon is emerging as a strategic asset. And with a veteran team driving development, US Critical Metals is positioned to play a central role in securing America’s energy future.

Proven Leadership With a Track Record of Success

US Critical Metals (CSE: USCM, OTC: USCMF) is guided by a management team whose past achievements speak volumes.

CEO and Director Darren Collins was an integral part of Hercules Metals that surged 40x in 2023—showcasing his ability to bring together assets and people to create significant value.

VP of Exploration Marco Montecinos is a seasoned expert with more than 35 years in the field. Marco’s extensive background includes work with major players like Billiton, Alta Gold, Francer Gold, and Placer Dome.

Top 5 Reasons to Add US Critical Metals (CSE: USCM, OTC: USCMF) to Your Watchlist

- Strategic Asset Portfolio — US Critical Metals holds diversified projects targeting key critical minerals: rare earth elements at Sheep Creek, uranium and vanadium at Long Canyon, plus cobalt at Haynes. These are minerals essential for clean energy, defense, and advanced technology.

- U.S.-Based Uranium Opportunity — Long Canyon is among the few domestic uranium projects in a country facing critical supply risks, especially amid sweeping government policies prioritizing nuclear energy expansion.

- Rare Earths in a U.S. Critical Mineral Hotspot — Sheep Creek sits in Montana’s Belt-Purcell Basin, a geologically rich corridor known for rare earth elements. Early work has identified 10+ potentially high-impact REE targets—which may position the project at the forefront of U.S. supply chain security.

- Experienced Leadership Team — With a CEO who has scaled exploration companies dramatically and a veteran technical team, the company is led by professionals who know how to create shareholder value.

- Geopolitical Advantage — In an era of supply chain disruption and increased government incentives for domestic critical minerals, these projects have strategic importance and potential for policy support.

As the U.S. races to secure key mineral inputs, US Critical Metals is developing projects with national strategic relevance. With a diverse portfolio, strong leadership, and projects located in mining-friendly jurisdictions, the company is well positioned to benefit from this accelerating demand.

To learn more and follow US Critical Metals’ progress, visit uscmcorp.com.

iihttps://a16z.com/its-time-to-mine-securing-critical-minerals/

iiihttps://uscmcorp.com/sheep-creek-carbonatites-assay-up-to-20-1-tree-and-363ppm-gallium/

ivhttps://finance.yahoo.com/quote/BIG.V/

vhttps://www.herculesmetals.com/wp-content/uploads/2024/09/Hercules-Metals_CorpDeck_2024-25-09.pdf

vihttps://uscmcorp.com/academic-team-presents-sheep-creek-rare-earth-project-at-seg-2022-conference/

viihttps://investingnews.com/daily/resource-investing/critical-metals-investing/rare-earth-investing/investing-in-rare-earth-heavy-vs-light/

viiihttps://features.csis.org/hiddenreach/china-critical-mineral-gallium/

ixhttps://www-pub.iaea.org/MTCD/Publications/PDF/TE-1877web.pdf

xhttps://mpmaterials.com/

xihttps://finance.yahoo.com/quote/MP/

xiihttps://www.world-nuclear-news.org/articles/amazon-google-meta-and-dow-back-tripling-nuclear-goal

xiiihttps://www.bloomberg.com/news/articles/2024-01-25/meta-building-new-800-million-ai-focused-data-center-in-indiana

xivhttps://www.bloomberg.com/news/articles/2024-01-25/meta-building-new-800-million-ai-focused-data-center-in-indiana

xvhttps://www.whitehouse.gov/articles/2025/05/president-trump-signs-executive-orders-to-usher-in-a-nuclear-renaissance-restore-gold-standard-science/

xviFrom low of $5.16 on 5/22/2025 to high of $13.17 on 9/15/25, https://finance.yahoo.com/quote/UEC/

xviiFrom low of $93.17 on 5/22/2025 to high of $243.48 on 9/15/25, https://finance.yahoo.com/quote/LEU/

xviiiFrom low of $4.50 on 5/22/2025 to high of $13.82 on 9/15/25, https://finance.yahoo.com/quote/UUUU/

xixFrom low of $51.70 on 5/22/2025 to high of $62.27 on 5/27/25, https://finance.yahoo.com/quote/CCJ/

xxhttps://finance.yahoo.com/quote/URA/

xxihttps://finance.yahoo.com/quote/HURA.TO/

xxiihttps://finance.yahoo.com/quote/OKLO/

xxiiihttps://finance.yahoo.com/quote/NNE/

xxivhttps://finance.yahoo.com/quote/SMR/

xxvhttps://www.npr.org/2024/06/14/nx-s1-5002007/bill-gates-nuclear-power-artificial-intelligence

xxvihttps://www.whitehouse.gov/articles/2025/05/president-trump-signs-executive-orders-to-usher-in-a-nuclear-renaissance-restore-gold-standard-science/

xxviihttps://scitechdaily.com/scientists-just-built-a-battery-that-never-needs-charging/

xxviiihttps://www.epa.gov/radtown/nuclear-power-plants

xxixhttps://www.eia.gov/todayinenergy/detail.php?id=64444

xxxhttps://www.mining.com/district-metals-says-viken-ranks-no-2-for-uranium-resource/

xxxihttps://www.world-nuclear-news.org/articles/government-inquiry-recommends-lifting-swedish-uranium-ban?utm_source=chatgpt.com

IMPORTANT NOTICE AND DISCLAIMER

This article is a paid advertisement. Think Ink Marketing and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by profiled companies or third parties to organize marketing campaigns, which include the creation and dissemination of these types of communications. In this case, in an effort to enhance public awareness of for US Critical Metals Corp.and its securities, USCM has provided the Publisher with a budget of approximately $50,000 USD to cover the costs associated with the creation and distribution of this communication. The Publisher may retain any excess sums after expenses as its compensation. This compensation should be viewed as a major conflict with our ability to be unbiased. Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur. This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by USCM) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP.

The Publisher does not own any shares of USCM and has no information concerning share ownership by others of in USCM. The Publisher cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

FORWARD LOOKING STATEMENTS.

This publication contains forward-looking statements, including statements regarding expected continual USCMwth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to USCM’s industry; (b) market opportunity; (c) USCM’s business plans and strategies; (d) services that USCM intends to offer; (e) USCM’s milestone projections and targets; (f) USCM’s expectations regarding receipt of approval for regulatory applications; (g) USCM’s intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) USCM’s expectations regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute USCM’s business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) USCM’s ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) USCM’s ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) USCM’s ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of USCM to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) USCM operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact USCM’s business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing USCM’s business operations (e) USCM may be unable to implement its USCMwth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

INDEMNIFICATION/RELEASE OF LIABILITY.

By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

INTELLECTUAL PROPERTY.

Think Ink Marketing is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.

IMPORTANT NOTICE AND DISCLAIMER

This website is owned and hosted by Tycona Media Ltd. Articles appearing on this website should be considered paid advertisements. Tycona Media Ltd. and its owners, managers, employees, and assigns (collectively “the Website Host”) is often paid by marketing companies to host websites on which articles profiling public companies are published. The Website Host has not been compensated by any of the profiled companies. The Website Host’s compensation for articles appearing on this website is as follows:

The Website Host has been paid approximately $500 per month while the advertisement campaign is active by Think Ink Marketing as compensation to host the article profiling US Critical Metals Corp. (“USCM”).

SHARE OWNERSHIP

The Website Host does not own any shares of any profiled compannies and has no information concerning share ownership by others of any profiled companies. The Website Host cautions readers to beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you read the articles on this website and this has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases.

NO SECURITIES OFFERED

The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to buy any security. Neither the articles on this website nor the Website Host purport to provide a complete analysis of USCM or its financial position. The Website Host is not, and does not purport to be, a broker-dealer or registered investment adviser. The articles on this website are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about USCM Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in USCM’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Website Host, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES

This website enables users to link to external websites not under the control of The Website Host. The Website Host has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Website Host expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.

INTELLECTUAL PROPERTY

The Tomorrow Investor is the Website Host’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Website Host is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Website Host to any rights in any third-party trademarks.

FORWARD LOOKING INFORMATION

This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect expectations regarding USCM’s future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to USCM’s industry; (b) market opportunity; (c) USCM’s business plans and strategies; (d) services that USCM intends to offer; (e) USCM’s milestone projections and targets; (f) USCM’s expectations regarding receipt of approval for regulatory applications; (g) USCM’s intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) USCM’s expectations regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute USCM’s business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) USCM’s ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) USCM’s ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) USCM’s ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption as a result of COVID-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of USCM to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) USCM’s operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as the COVID-19 pandemic may adversely impact USCM’s business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing USCM’s business operations (e) USCM may be unable to implement its growth strategy; and (f) increased competition. Except as required by law, the Website Host undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise.

HISTORICAL INFORMATION

Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of USCM or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of USCM or such entities and are not necessarily indicative of future performance of USCM or such entities.

STOCK INFORMATION

Symbols: CSE: USCM | OTC: USCMF

RELATED NEWS